With merchant risk being as important for payment facilitators as it is with traditional merchant-services companies, Infinicept, which provides embedded payment services, and LegitScript, a merchant-monitoring service, are collaborating on a new service to provide merchant-monitoring capabilities.

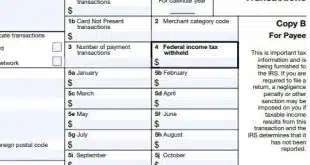

Announced Wednesday, the service will enable payfacs, independent sales organizations, and merchant acquirers to underwrite merchants with a full set of screening tools, automatically board and begin merchant monitoring in one integration, and help reduce risk. Denver-based Infinicept is providing the underwriting and transaction-monitoring tools, and Portland, Ore.-based LegitScript is supplying the persistent online merchant-monitoring access.

Merchant monitoring is essential because of the potential for bad actors to introduce products or services later that would not have passed muster when the merchant initially was onboarded. The Infinicept/LegitScript offering is aimed at making it easier for payments providers to review their portfolios for transaction laundering, noncompliant Web sites, the sale of illegal goods, and other risk elements, Infinicept says.

“Our platform allows companies to participate in commerce in a way that provides the best merchant experience and where the software company keeps the majority of its payments revenue, all while keeping the ‘bad actors’ out of their business,” said Todd Ablowitz, Infinicept cofounder and co-chief executive, in a statement.

LegitScript said online merchant monitoring is important because it can help providers stay ahead of problematic merchants and reduce the number of violations.

“Merchant monitoring is s essential to maintaining a safe payments ecosystem to safeguard everyone’s money and well-being,” Deana Rich, Infinicept cofounder and co-CEO, tells Digital Transactions News in an email. “Websites change constantly and there is no way a human can stay on top of it. Using an MMSP ensures you will know if they add a product or sales method that is harmful, illegal or not allowed.”

The combined service can give payfacs more protection and an onboarding process they know incorporates online risk and compliance monitoring, Rich says.