PayPal Holdings Inc. has added four new features to its payment service for small online businesses that are expected to increase conversion, reduce declines and the risk of fraud, and provide greater transparency into processing costs.

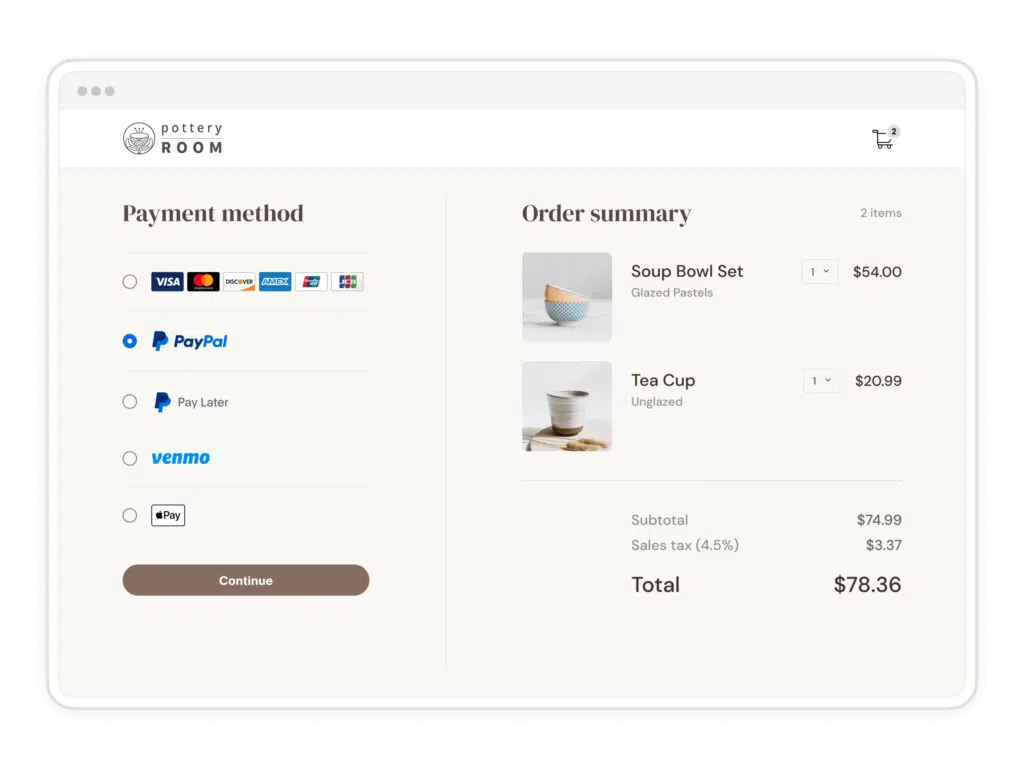

PayPal’s small business customers will now be able to offer Apple Pay at checkout, save a customer’s payment method for future purchases, automatically update lost, stolen or expired cards-on-file to reduce declines at checkout, and receive Interchange ++ pricing.

Interchange++ is a pricing model that provides a detailed explanation of the acceptance fees merchants are charged, such as the interchange fee paid to the card issuer, the fees levied by Visa Inc. and Mastercard Inc., and the fee paid to the acquirer. Businesses will have the option to choose between Interchange ++ or flat-rate pricing. PayPal will charge small businesses 2.59% + 49 cents for alternative payment methods and other digital wallets. Pricing for PayPal payments will be 3.49% + 49 cents.

The inclusion of Apple Pay as a payment option, in addition to PayPal, Venmo and PayPal Pay Later, is expected to help e-commerce merchants reduce shopping cart abandonments. A recent Ponemon Institute study revealed that 59% of respondents abandon their shopping cart when they cannot pay using their preferred payment method.

PayPal will also offer fraud protection, chargeback protection and seller protection, on eligible transactions.

“The retail landscape is constantly evolving and small and medium businesses need access to a range of tools to help them drive sales, cut costs and protect themselves and their customers from fraud,” Nitin Prabhu, vice president, merchant experiences and payment solutions for PayPal says in a statement.

In related news, Virtualitics Inc., a provider of artificial intelligence-driven data exploration, has partnered with payment processor North American Bancard to eke out data insights.

Virtualitics uses artificial intelligence and 3D visualizations to pinpoint patterns and trends. Virtualitics’ patented technology is based on more than 10 years of research at the California Institute of Technology.

“Virtualitics’ mission is to empower organizations to solve complex, business-critical problems using Intelligent Exploration,” Virtualitics chief executive and co-founder Michael Amori says in a statement, adding that financial services is a key vertical for the company.