While rewards are the biggest reason consumers choose a credit card, cardholders believe issuers have more room for improvement when developing rewards programs, especially when it comes to personalization, according to Marqeta Inc.’s 2023 State of Credit report.

The report reveals that 58% of consumers surveyed cited rewards as the leading factor for choosing a credit card, followed by convenience (46%) and fraud protection (44%). In the survey consumers could cite more than one reason for selecting a credit card. Marqeta surveyed 3,000 consumers globally earlier this year, including 2,000 in the United States.

Cashback is the most popular reward among consumers (66%), followed by multipurpose points (27%) and gift cards (27%). In the U.S., some 71% of respondents cited cash back as the top reward. Cashback is also slightly more popular with women (68%) than men (63%).

While rewards are a primary reason many consumers choose a credit card, 77% of respondents think there is room to personalize rewards around a cardholder’s interests or spending habits. In addition, 59% of all respondents say they would want extra points or cash back to spend on the specific merchant categories where they spend the most money. Among consumers 18 to 25, 58% want extra points or cash back to spend on specific merchant categories, followed by 47% of consumers 35 to 50.

“Our 2023 State of Credit report shows that consumer decisions to apply for a new credit card rely less on their satisfaction with their current cards and more on their desire for differentiated credit offerings,” says Todd Pollak, chief revenue officer for Marqeta, in a statement. “While rewards may initially pique consumer interest in applying for new credit cards, it’s the ability to customize rewards and integrate them into shopping experiences that will earn adoption and loyalty.”

While rewards are a key factor in determining which cards consumers use, cardholders have become increasingly reliant on their favorite brands to provide credit products. Some 50% of consumers in the U.S. own a co-branded card. Surprisingly, 55% of co-branded cardholders consider the brand to be ultimately responsible for customer service, while 62% consider themselves a customer of the brand instead of the bank.

Brand allegiance is especially strong among consumers 18 to 44, as this demographic tends to look for their favorite brands to provide personalized credit options.

Buy now, pay later, which has exploded in popularity, is increasingly being viewed by consumers as a way to access additional credit services. Some 71% of BNPL users in the U.S. would be interested in accessing other financial services through their BNPL provider, up from 52% in 2022. In addition, 60% of BNPL users say they already use additional credit services from their BNPL provider.

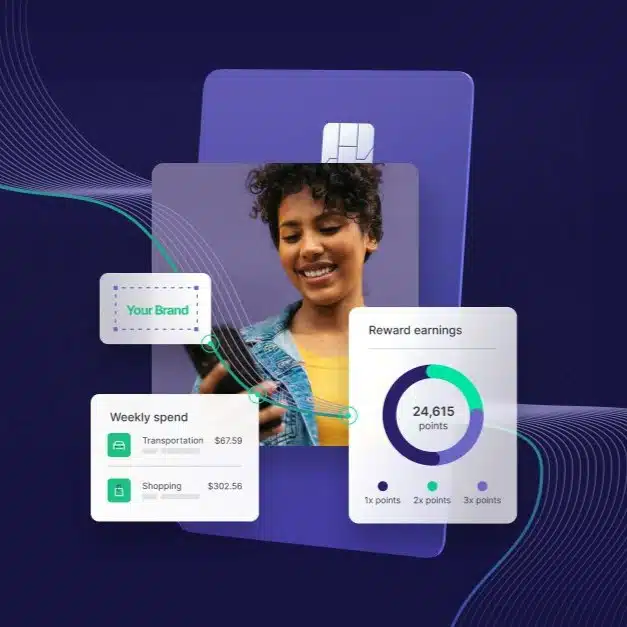

In related news, Marqeta unveiled a credit card platform that allows brands to launch consumer and commercial credit programs that deliver personalized rewards and embed cardholder preferences directly in the brands’ existing mobile apps or Web sites.

Card issuers can tap cardholder data that allows them to build rewards programs based on a cardholder’s preferences. The platform can also be used to create rewards programs for commercial cardholders that enable them to reinvest in the business through customized rewards categories.

“Brands wanted to reach customers on a laptop, and then their pocket, and now they have the opportunity to be in their wallet, as the credit card becomes a new launchpad of the digital experience. We believe this launch can help reimagine what a credit card can be, and show that beautifully designed, embedded credit cards can help innovative brands engage with customers in a whole new way,” Marqeta chief executive Simon Khalaf says in a statement.

“The possibility is huge, but the incumbent solutions are simply not giving consumers what they need,” he continues. “We want our credit card platform to completely change the consumer experience and the brand-loyalty equation.”