FIS Inc. is selling a majority stake in its massive Worldpay transaction-processing operation, but that doesn’t mean the company is ditching the payments business, its chief executive made plain early Tuesday.

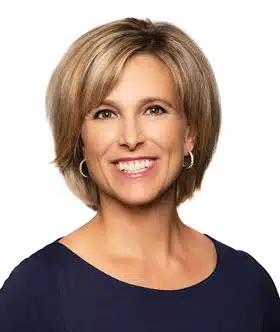

“We have not moved totally away from that,” Stephanie Ferris told equity analysts during an early-morning call to review FIS’s third-quarter results. “We do process debit card transactions.” She stressed the advantage she says FIS has in processing online debit in particular, following a rule clarification issued by the Federal Reserve this summer that enforces a decade-old requirement that banks make network choice available for debit on e-commerce as well as in-store transactions.

That capability, Ferris noted, “should be a needle-mover” for FIS. “We’ve tripled down on selling it,” she added. “I continue to press the guys. We have a significant advantage there.” Among the company’s assets is the NYCE ATM network, which ranks among the nation’s largest such systems. “It should be a needle-mover,” Ferris said.

The debit business is part of the company’s banking division, one of the two units that remain now that FIS has moved Worldpay into a “discontinued operations” category on its balance sheet. Capital markets is the other division. FIS agreed in July to sell a 55% stake in Worldpay to the Chicago-based private-equity firm GTCR. The move follows the processing company’s 2019 acquisition of Worldpay for a reported $43 billion.

The GTCR deal “remains on track to close in the first quarter” of 2024, Ferris said Tuesday.

The banking unit includes FIS’s debit business, including the NYCE system. But it is also a major participant in processing for FedNow, the real-time payments system the Federal Reserve launched in July. Ferris said Tuesday some 190 client institutions are now “in the pipeline” at FIS to participate in FedNow, up from 160 in the last quarter.

For the quarter, FIS reported $3.7 billion in revenue, up 2% year-over-year, including $2.5 billion from continuing operations and $1.2 billion from Worldpay. The company now expects the Worldpay transaction to yield more than $12 billion in proceeds, up somewhat from its previous estimate of $11.7 billion.

As with many payments-processing stocks, FIS shares have taken a beating this year. The stock was trading at just shy of $51 per share at midmorning, down by about 25% from its 2023 high of $67.85 in early February.