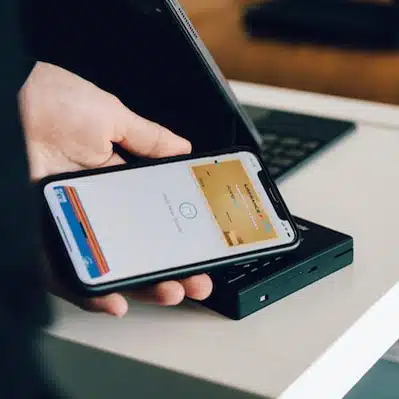

Roughly a decade after Apple Pay and other digital wallets burst into the U.S. payments market, the apps seem to be well on their way toward mass adoption, according to consumer-survey results released early Wednesday by the Electronic Transactions Association and the consulting and research firm TSG.

In line with rising interest in wallets, tap-to-pay, or contactless, payment technology is also gaining steam, along with peer-to-peer payments apps, according to the research, which is included in the ETA/TSG report, entitled “2023 Consumer Holiday Spending Study.” The study is the latest in a series released each year since 2020.

Of the 1,005 consumers the ETA and TSG surveyed in late October, 30% said they used the wallet apps “frequently,” second only to the 34% registered by “tap-to-pay,” a contactless technology that can also be used with cards. Some 79% had used wallets at least once, up 14 percentage points from 2022. Overall, tap-to-pay came in a close second, with 78% having tried the technology at least once, up 11 percentage points.

When it comes to frequent use, P2P apps came in third, with 26% citing that payment method. Some 78% had tried one of the apps at least once, up 8 percentage points. Popular apps in this category include PayPal Holdings Inc.’s Venmo and Early Warning Services’ Zelle.

Buy now, pay later ranks near the bottom, with just 6% citing frequent use and 64% indicating they had never used the product, which allows consumers to split purchases into near-term installments, typically at no interest. Some 36% had tried BNPL at least once in the past year, unchanged from 2022, a possible sign that BNPL is cooling off after a torrid run in the wake of the pandemic. Consumers continue to be cool toward cryptocurrency, with just 3% having used it frequently and 82% having never used it. Eighteen percent had tried digital currency at least once, up 2 points.

QR codes, on the other hand, are registering strongly among consumers. While just 5% indicated they use the codes frequently, 50% have tried them at least once, up 18 percentage points from a year ago, the biggest gain among the seven payment methods surveyed.

Among wallets, the researchers asked consumers how “confident” they felt if they left the house without a physical wallet but could use any of several named digital alternatives. Some one-third of Apple Pay users indicated confidence, up 10 points, the biggest gain among the surveyed wallets. The most popular wallet, PayPal, sustained a one-year drop in confidence, from 64% to 58%. Two other major wallets also lost ground on this measure, with Google Pay down from 25% to 21% and Amazon Pay slipping from 14% to 12%.

But the study found gains for most of the P2P apps studied, with Venmo (41% using, up from 34%) taking over the lead from Block Inc.’s Cash App (38%, down from 41%). Zelle shot up from 24% to 33%, while Apple Pay Cash rose to 17% from 11%. The number of non-users dropped from 33% to 26%.

For buy now, pay later, the most popular app is PayPal Credit, though at 14% of users it by no means dominates the market. Affirm (13%, up from 10%), Afterpay (12%, down from 13%) and Klarna (12%, no change) follow closely behind.

Among all consumers surveyed, ease of use, at 29%, was the top determinant of which app to adopt, though it’s followed closely by the one that offers the “best deal” (28%) and the app that is seen to be the “most secure” (24%).