WeGetFinancing has partnered with SensePass, a provider of alternative payment solutions, to provide a buy now, pay later solution for high-ticket items. WeGetFinancing is a BNPL gateway operated by Emerging Payments Technologies Inc.

Merchants on the SensePass platform can now offer BNPL financing for purchases of up to $15,000, with a repayment schedule of up to 60 months. Consumers can finance such high-ticket items as appliances and jewelry. The financing option will be available to physical and online merchants.

The two companies say they teamed up because many BNPL providers do not support financing for items costing more than $5,000. They also say they aim to bring BNPL financing to more in-store retailers. The installment-payment option has been adopted by fewer than 3% of in-store merchants, according to SensePass.

“Due to the state of the economy and the high cost of borrowing money, many BNPL lenders are only approving credit scores that are 680+ and tickets below [$5,000],” a WeGetFinancing spokesperson says by email. “WeGetFinancing created a full credit spectrum solution that does not isolate buyers from obtaining the financing they need. We have seen transactions as high as [$15,000] for customers in near-prime credit positions with our lenders.”

This partnership also provides WeGetFinancing, which currently works with 25 merchants including Modular Closets and computer retailer OriginPC/Corsair, a stronger in-store presence, the company says.

SensePass works with such BNPL providers as Affirm, AfterPay, Klarna, Splitit, Zezzle, and Zip.

Offering BNPL options for high-ticket purchases comes with higher risk than is found with typical BNPL financing, experts warn.

“The higher the ticket, the greater the chance for fraud.,” Ariana-Michele Moore, an advisor for retail banking and payments at the consultancy Datos Insights, says by email. “The longer the payback period, the greater the risk that the consumer won’t or can’t pay. Higher-ticket, long-term period payment options begin to resemble a traditional installment loan.”

Most consumers use BNPL for purchases of less than $500, Moore adds. Some 34% of consumers used BNPL to finance purchases of less than $500 in the past 12 months, compared to the 1% of consumers who used the financing option for purchases of $10,000 or more, according to research by Datos Insights. It surveyed 606 consumers in the United States who had a financial-institution relationship and use BNPL.

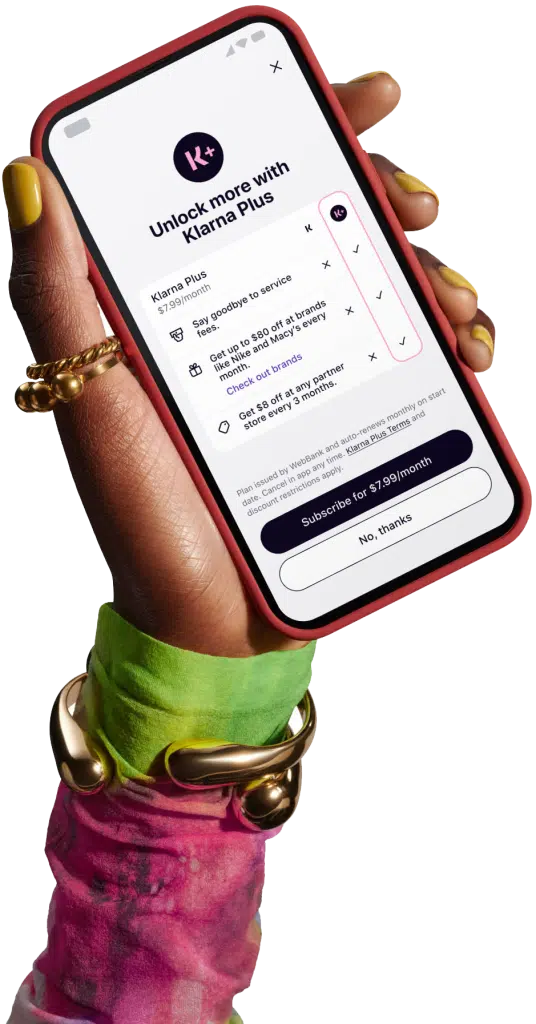

In other BNPL news, the big payment platform Klarna AB announced its Klarna Plus subscription service has attracted 100,000 U.S. subscribers since its debut earlier this year. Klarna Plus enables eligible consumers to earn double rewards points on purchases, pay no service fee when using Klarna at merchants outside of the Klarna network, and receive “exclusive” deals for $7.99 a month.

In the program’s first month, Klarna Plus subscribers saved an average of $18, equaling an estimated $1.8 million in total savings, according to the company. In addition, more than 27,000 discounts have been used so far by Klarna Plus members with Klarna’s retail partners.