Capchase, a financing platform that funds software-as-a-service companies based on future recurring revenue, announced early Wednesday a partnership with the processing giant Stripe Inc. to provide buy now, pay later financing for SaaS vendors in the United States.

The deal, which marks Stripe’s entry into B2B BNPL in the U.S., will provide B2B buyers with more flexibility in paying for purchases by allowing them to split large annual contracts into monthly payments, according to the two parties. Typically, B2B sellers offer such payment terms such as paying within 30, 60, or 90 days of the invoice date.

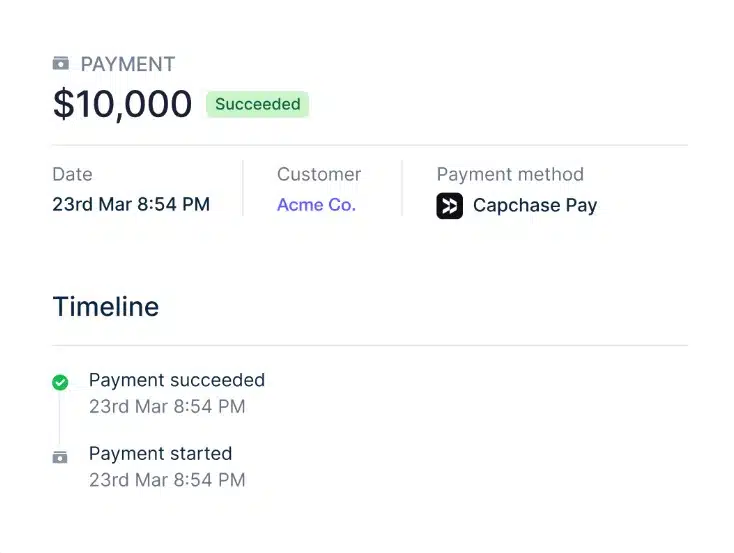

Offering more flexible terms is expected to help B2B sellers close more deals while being paid in full upfront. Capchase will handle the collection of BNPL payments and cover any losses incurred, the company says. B2B buyers applying for a BNPL loan through Capchase receive their approval in five minutes or less, the New York City-based company says.

Capchase, which will embed its B2B BNPL payment solution in Stripe’s platform, has already made its B2B BNPL option available to more than 1,000 software-as-a-service businesses. Among its customers offering B2B BNPL, Capchase has seen the average contract value for their clients increase 50% and conversion rates increase between 15% and 30%, the company says.

Founded in 2020, Capchase has operations in North America and Europe and has worked with more than 5,000 businesses and partners to date.