Mastercard Inc. announced early Tuesday it is acquiring Minna Technologies, a provider of subscription-management applications. Terms of the acquisition were not disclosed.

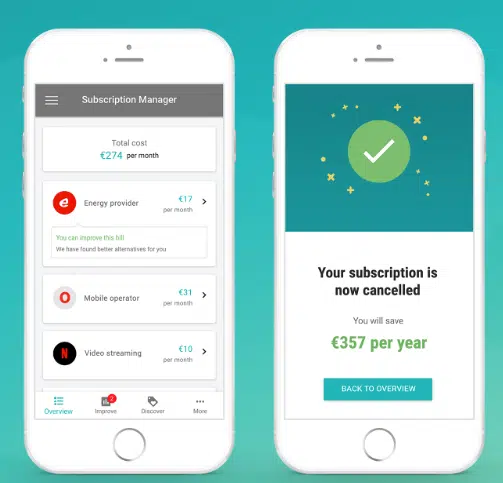

The acquisition will enable consumers to more easily manage, renew, and cancel their subscriptions by providing them a single view of all their subscriptions within their banking apps or Web site, or in a central hub. Providing consumers the tools to more effectively manage their subscriptions in one place can reduce operational costs and build cardholder loyalty, Mastercard says.

Subscriptions are a rapidly growing segment of the payments business. There are 6.8 billion subscriptions globally, a figure that is expected to rise to 9.3 billion by 2028, according to Juniper Research.

Offering cardholders better subscription-management tools opens the door to building deeper, longer-term cardholder relationships by creating new experiences and services around each subscription, Mastercard adds.

Mastercard also plans to provide cardholders more information around their subscriptions, such as digital receipts, to help reduce involuntary churn and create greater value. The network adds that it will also give subscription-based merchants the tools to interact with their customers in real time.

In addition to the Minna acquisition, Mastercard announced a partnership late Monday with Amazon Payments Services. The deal calls for Amazon to adopt Mastercard Gateway, the card network’s global omnichannel payment gateway. This is expected to provide Amazon merchants with a single point for payment processing across 40 markets in the Middle East and Africa region, including Bahrain, Egypt, Jordan, Kuwait, Lebanon, Oman, Qatar, South Africa, and the United Arab Emirates.

The deal is positioned by the parties as creating new opportunities for Amazon to build relationships with such entities as telcos and governments by enhancing their checkout options and driving faster, more secure transactions.

Some 95% of consumers in the Middle East and Africa are considering using emerging payment methods, such as wearables, biometrics, digital wallets, QR codes, and contactless payments, according to the Mastercard Payment Industry Insights Index.

Merchants not offering such emerging payment methods are at risk of losing out on business, as 61% of consumers in the region say they would avoid purchasing from merchants that do not accept electronic payments, Mastercard says.

Banks in the region that have migrated to digital channels have seen the share of digital transactions increase from 70% to 90% over a two-year period, Mastercard adds.

The deal also calls for Mastercard and Amazon to develop Secure Card on File, Click to Pay, and token authentication services to provide multi-rail checkout options to merchants, as well as a faster checkout experience.