Bill-payment platform doxo Inc. has launched an app it says streamlines both bill payment and management and helps consumers avoid hidden costs, such as overdraft fees, when paying their bills.

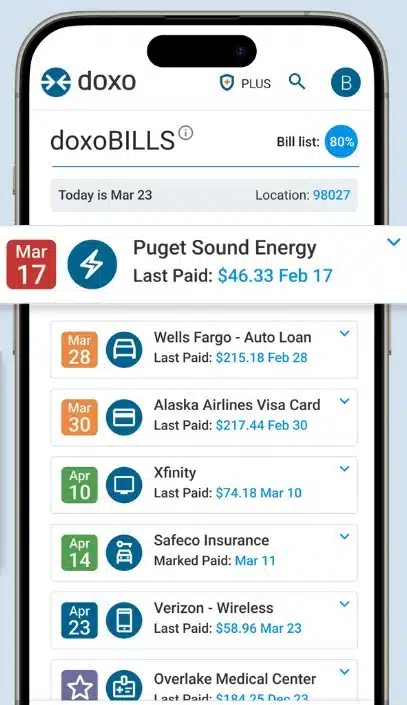

The app, called doxoBILLS, allows users to organize and pay bills to more than 120,000 billers and pay any biller through a digital wallet without sharing their bank or card information. The so-called Private Pay Wallet feature also enables consumers to update their wallet once when their bank or card account changes and applies the updated information to all associated bill payments.

The app also allows consumers to view account balances in real time before paying a bill. The feature is intended to help avoid overdraft fees, which cost U.S. consumers $8 billion annually, doxo says.

The app helps users track and improve their credit scores through a dashboard, and provides users with up to $1 million in identity-theft insurance and identity-restoration services. It also has the ability to compare any type of bill or the total cost of bills locally or across the country, the company says.

Doxo created the app to remove what it sees as friction and fragmentation in the bill-payment experience, which it says is typically built according to the needs of individual billers or financial institutions. The complexity of existing bill-payment apps creates many “hidden costs” for consumers, which include late and bank-overdraft fees, identity fraud, and detrimental credit impacts, according to doxo. Those fees collectively cost U.S. households $196 billion annually or $1,495 per household, up 18% from 2023, according to the company.

“The need for the all-in-one doxoBILLS app arose from the fragmentation of traditional bill-payment systems, which are typically tied to individual billers or financial institutions,” Liz Powell, senior director for communications at doxo, says by email. “doxoBILLS empowers consumers by providing a unified view of all their bills and due dates, offering the flexibility to pay any bill using any financial institution. Additionally, it incorporates key financial protections to enhance credit, minimize late and overdraft fees, and safeguard online security.”

Consumers in the United States pay 10 bills per month, on average, and spend more than $4.46 trillion annually, or about a third of all consumer spending, on bill payment, according to doxo.