The digital-payments revolution may finally be poised to relegate cash to the sidelines of finance. Worldwide, 471 billion so-called cashless transactions flowed through payments networks in 2015, a 52% increase since the end of 2011 and up 13% over 2014, according to numbers released this week by Retail Banking Research Ltd.

Meanwhile, cash withdrawals grew 33% over the same four-year period, according to RBR’s latest report. The U.K.-based research firm uses cash withdrawals as a proxy for cash usage, while recognizing that a single withdrawal could fund multiple transactions.

Cashless transactions consist of payments by card, check, credit transfers (used for applications like payroll), and direct debits (used for recurring payments). Cards account for 55% of these transactions, up from 50% at the end of 2011.

In RBR’s previous report, released at the end of 2015, cash was growing nearly apace with electronic transactions globally, registering a 7.1% average annual rate of growth from 2010 through 2014, compared to 7.6% for cashless payments. But in the period examined by the latest report, 2011 through 2015, the gap widened, with cashless transactions growing at a 9.3% clip annually compared to 7.4% for cash withdrawals.

For the United States, cashless transactions increased from 103 billion to 118 billion over the 2011 to 2015 span, according to RBR.

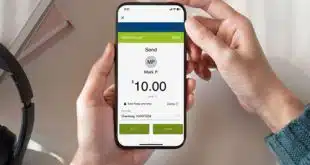

The firm credits technologies such as contactless payments for the growth of cashless transactions. Contactless transactions, which work with radio-wave transmission and allow consumers to wave or tap a card rather than swipe or dip it, tend to be low-ticket payments, where cash has historically been dominant. Electronic forms of person-to-person payments, particularly as faster-payments networks take hold, are also expected to crimp cash usage, RBR says.

In the United States, contactless has not developed as quickly as in markets like the United Kingdom, but RBR expects this picture to change. “In the U.S., the focus has been on EMV migration over the last few years,” Chris Herbert, senior associate at RBR, tells Digital Transactions News by email. “Nevertheless there has been a rapid increase in the number of contactless-enabled terminals and several mobile wallets have been launched since 2014. It will take a long time, but I would expect contactless to eventually make a breakthrough in the US, whether in the form of cards or mobile wallets.”