U.S. Bank tried, but it couldn’t make its $6.95 fee for real-time person-to-person payments stick. The nation’s fifth-largest bank by assets disclosed Wednesday that such payments are now free.

The Minneapolis-based bank says it was the first to go live with real-time payments over the bank-developed clearXchange P2P payments network, which is now part of Early Warning Services LLC. In March, U.S. Bank said it was charging customers who used its Send Money service, which goes over clearXchange, $6.95 for a real-time P2P payment.

Trouble was, practically no one else was charging for similar payments. Not the three founders of clearXchange: Bank of America Corp., JPMorgan Chase & Co., and Wells Fargo & Co. Nor did the leading non-bank P2P players such as PayPal Holdings Inc.’s Venmo and Square Inc.’s Square Cash.

The last straw for U.S. Bank’s fee may have come in late June, when Wells Fargo announced it was adding a real-time component to its four-year-old clearXchange-based P2P service and making it free, according to Talie Baker, an analyst with Boston-based Aite Group LLC who researches the P2P market.

“The general idea in the marketplace is that P2P should be a free service,” Baker tells Digital Transactions News. “If banks are not offering it for free, they’re going to lose the ability to make P2P [transactions].”

U.S. Bank cast the decision to drop the fee as a result of clearXchange’s increasing adoption rather than of what other P2P payment providers are charging. The bank didn’t disclose Send Money transaction volume.

“As the platform expanded and real-time payments became more broadly available, U.S. Bank decided to make the service available with no fee,” a spokesperson tells Digital Transactions News by email.

Like its cohorts, U.S. Bank now faces the question of how to generate revenues and profits from a service that likely cost its founders and owners millions of dollars to develop. It’s a problem similar to the one banks faced a few years earlier, when they encountered strong consumer resistance to fees for electronic bill payments.

As with bill pay, the solution seems to be indirect by bundling P2P payments into other revenue-generating products or by casting it as a retention service that reduces the cost of acquiring new customers.

“I think it’s to keep the customer base stickier, and to make them use services that they charge a fee for,” says Baker.

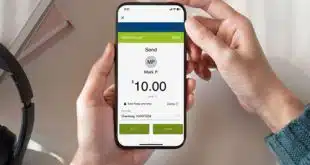

Send Money is available to any U.S. Bank customer enrolled in online banking and requires only a recipient’s mobile phone number or email address to start. Once set up, payments can be sent from a mobile device. Recipients can withdraw funds at bank branches, ATMs, and the point of sale.

U.S. Bank, the lead bank of U.S. Bancorp, invested in clearXchange early in 2015, about four years after BofA, Wells, and Chase founded the service and a year after Capital One Financial Corp. became the fourth owner. The banks sold clearXchange in October to Early Warning, a bank-owned fraud-prevention firm of which U.S. Bank is now a part-owner.