By Kevin Woodward

@DTPaymentNews

In the quest to position their credit cards as the preferred payment method in mobile wallets, issuers may want to target consumers in the right demographic group who have preferences that match what the card offers, if the newly released “J.D. Power 2016 U.S. Credit Card Satisfaction Study” is any indication.

Figuring that out takes a lot of data, but the stakes are important. A cardholder may load several cards into a mobile app like Apple Pay, but over time he or she is likely to use just one card in that app all or most of the time, experts say.

To win that favored status, issuers should start by zeroing in on consumers younger than 40 with annual incomes of $80,000 or more, according to the study, which includes responses from more than 20,000 credit card holders. It turns out 43% of these consumers use a mobile payment app, while only 13% of consumers overall do so.

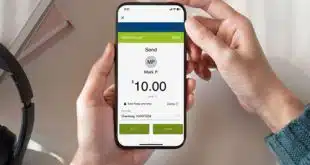

Issuers, especially larger ones, heavily promote their cards as ideal for mobile wallets. Consumers want an easy experience with their cards, and when that happens they may be more likely to use that particular credit card more than others.

That makes a streamlined experience a crucial factor. While getting a card into the top-of-wallet position is but one of many tasks facing issuers, it takes on greater importance with mobile wallets because of the additional steps consumers must take to make it the preferred card in these services. Consumers need handsets that work with mobile wallets and they must download the needed apps. Then they must load their credentials into the wallet, a step that may require calling the issuer to verify the user’s identity.

Finally, what can boost the chances for an issuer’s card becoming the preferred one for a consumer is ensuring the card matches with the consumer’s shopping and spending habits, the J.D. Power study says.

“Credit card issuers should be more proactive in helping their customers understand and use their rewards and benefits, as well as make offers to switch customers to cards that better fit their needs. In the long term, it is in everyone’s best interest for cardholders to have the right card,” said Jim Miller, senior director of banking at J.D. Power, in a statement. “For cardholders, switching cards to one that best meets your needs doesn’t have to mean switching providers. In many cases, the current provider may have a card that is better suited for you.”