While simple to merchants and consumers, the rapidly growing payment-facilitator model involves multiple considerations for developers and acquirers.

Some of the best ideas in payments come around only once, but many, such as the payment-facilitator model, come around again when they better suit merchants and the payments industry.

To put it briefly, payments facilitators are companies that sign up merchants for payment-card acceptance accounts under an umbrella agreement that doesn’t require each merchant to have a separate acquirer agreement. And these days, payment facilitators are generating a lot of interest inside and outside of the payments industry.

PayPal Holdings Inc., which dates to 1998, and Square Inc., founded in 2009, are two of the most well-known examples of payment facilitators, which at one time were also known as aggregators or payment-service providers.

As the PayPal and Square examples show, payment facilitators offer an especially attractive tool for software developers and payments companies courting new card-accepting merchants, which are often called submerchants.

Understanding when, why, and how the payment-facilitator model works could help payments companies find new merchants and provide an additional revenue source from existing merchants. Indeed, Payfac, an often-used shorthand term for the model, is a registered trademark of the big merchant processor Vantiv LLC.

‘We Process Those Transactions’

One example of the model is apparent in how USA Technologies Inc., an unattended-payments specialist, uses it. USAT, which provides payments services and point-of-sale hardware for merchants such as vending-machine and parking operators, has used the model since 1993, says Mike Lawlor, chief services officer at the Malvern, Pa.-based company.

“We recognized many years ago that the way traditional POS-services companies did business would not allow the industry we work in to easily and rapidly scale,” Lawlor says.

The typically low average ticket of vending-machine transactions makes them ideal for the payment-facilitator model. “When we sell or lease one of our [point-of-sale] terminals, we set up the terminal account and the terminal IDs,” Lawlor says. “We process those transactions.”

USAT also has pacts with Visa Inc. and MasterCard Inc. for reduced interchange rates for small-ticket debit card transactions in the unattended beverage and food-vending merchant categories.

Lawlor says 429,000 machines use the USAT service, of which more than 300,000 have contactless-payment capability. USAT has more than 11,000 clients, each of which pays a blended rate for each transaction. USAT handles settlement to merchants, Lawlor adds.

The payment-facilitator model is well-suited to online merchants, too. YapStone Inc., a Walnut Creek, Calif.-based payments firm, has used the model for HomeAway Inc., a private-lodging booking service. HomeAway is a marketplace that enables property owners to offer rooms, houses, and apartments to renters. HomeAway says it has more than 1.2 million listings.

YapStone enables property owners to accept payments using the payment-facilitator model, says Bruce Dragt, YapStone’s senior vice president of product. “We sign them up for the service directly and direct funds to them,” Dragt says. “We are the entity that handles all of the chargebacks and risk. We take on the role of the payment provider. We make that fit without impeding the flow and process of the marketplace itself.”

‘A Choppy Experience’

Simplifying the payment experience—for the consumer and the merchant—is a key characteristic of the payment-facilitator model. Unlike a traditional merchant-boarding process, the applicant typically completes a single online form on one Web site that requests the minimum of information, just enough to verify a person’s identity and to assess risk. The applicant knows he is dealing only with one company, and is unaware of the acquirer or the independent sales organization on the back end.

In this way, payment facilitators “are the entire face to the merchant,” says Todd Ablowitz, president of Double Diamond Group LLC, a Centennial, Colo.-based consulting firm. “Everything from the software to the transaction processing to the statements to the funding from the bank account.”

Ablowitz’s firm helped the Electronic Transactions Association (“Triumph And Challenge at the ETA,” July), a Washington-based trade group for acquirers, develop underwriting guidelines for payment facilitators that were expected to be released last month.

“An ISO is required to show the bank name on the application and the bank is party to the agreement with the merchant,” says Ablowitz. “The payment facilitator doesn’t have those requirements. It gives the software [developer] enormous flexibility to make the merchant application and reporting much more seamless.”

Also, unlike the traditional merchant account, the payment-facilitator account is more apt to be used to serve a particular vertical instead of being a broad-based service for any type of merchant. As with the HomeAway and USAT examples, the payment-facilitator model is best suited to merchant types where the service and payment can be highly integrated. It is especially popular with independent software vendors and value-added resellers.

“They are popular because ISVs and VARs want to be able to focus on the software and services they provide and ensure that payments do not cause friction in the integration of their product or service,” says Cleveland Brown, chief executive of Payscout Inc., a Sherman Oaks, Calif.-based payments company. “When you have payments integrated into the software or service of the payment facilitator or aggregator, it becomes part of the boarding process for that customer utilizing their service, as opposed to a separate process of finding the provider, applying, and getting approved [for a merchant account].”

As Ablowitz explains, those separate accounts, which may include the processor, the payment gateway, and the software provider, carry their own statement and fee structure. “In the end you get a choppy experience for the merchant and the consumer,” he says. “It’s very hard to solve without the payment-facilitator model.”

‘Show Your Confidence’

While a service setup using the payment-facilitator model may have a simple and easy-to-use interface for merchants or consumers, the back-end setup is a bit more complex.

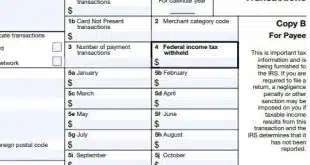

For starters, MasterCard Inc. and Visa Inc. require companies to register as payment facilitators. Visa charges $5,000 to register a payment facilitator as a third-party agent. Each card brand has its own set of rules. To get that registration, the organization that wants to be a payment facilitator must use a Visa client, such as an acquiring bank, to complete the registration process.

Also, being a payment facilitator is not a one-and-done process. MasterCard, for example, requires the parent organization to educate and train submerchants on compliance with the card brand’s rules. The payment facilitator also must maintain the names, addresses, and URLs of its submerchants, and monitor their payment activities. Both Visa and MasterCard prohibit payment facilitators from sponsoring other payment facilitators.

Then there is establishing the relationship between the payment facilitator and the acquirer and other payment entities.

RunSignUp LLC, a Moorestown, N.J.-based company that offers running-event registration services, shared its experience last year dealing with rules-enforcement by the card brands. It became a payment facilitator in 2015. Companies contract with RunSignUp for participants to register for an event, with RunSignUp assessing a fee that is dependent on the checkout total.

According to a RunSignUp blog post, the company had been gathering the money it collected from events into its own merchant account and then distributing it to event organizers once its fees had been deducted. As it grew, this practice became less acceptable to the company’s banks.

Having switched banks twice under this setup, RunSignUp in 2013 moved its account to Braintree, the payment service owned by PayPal Holdings Inc. Braintree is an authorized payment facilitator. Last year, RunSignUp made the decision to become a payment facilitator to help improve its process and better comply with rules and regulations as it grows. It still uses Braintree for some services.

Finding an acquirer is a vital step. Dragt says most acquirers support the payment-facilitator model. An acquirer may have staff that specifically supports payment facilitators, he says. But prospective payment facilitators will have to determine if the acquirer’s risk appetite is aligned with their goals.

Acquirers, usually in the initial phase of the relationship, will audit the payment facilitator to understand its risk, compliance, fraud, and boarding policies, says Payscout’s Brown. “There are usually interactions around the boarding process and the issuance of the master merchant ID numbers as the acquirer will generally issue the MID once the payment facilitator has requested the opening of the merchant’s account,” he says.

Underwriting and liability are other matters that present unique challenges for payment facilitators. “To step into doing the payment-facilitator model, one of the key first things to consider is the appetite for risk,” says YapStone’s Dragt. Payment facilitators, to function effectively, “have to have the capital to sustain the risk of any of the transactions and be able to provide that and have processes and controls around that,” he says.

At USAT, even though it has minimal fraud activity given the small-ticket transactions many of its clients experience, due diligence is performed on each customer, says Lawlor. “In terms of our clients, it’s the gamut of any retail business, having big global companies and small independent companies,” he says.

Other considerations include having staff in place to ensure operations, underwriting, and technology work smoothly, says Dragt. “You need to consider that and be able to show your confidence in that to an acquirer before you can even consider this an opportunity,” he says.

Exploding Segments

Confidence in the payment-facilitator model is quite high among many. “It will see a lot of attention because the end business segments it supports are very much growing,” says Dragt. “As you look at digital marketplaces, ISVs, those are segments that are exploding.”

Brown says the future includes investing in systems that can handle the risk, compliance, and boarding requirements set by regulators and the card brands.

“The key is we have to be flexible to continue to expand our services based on consumer demand and consumer payments,” Lawlor says. “We have to make sure, wherever the customer is heading toward, we incorporate that into our solutions and services.”