Gideon Samid • Gideon@AGSgo.com

Protests against the so-called tyranny of the 1% can take several forms. One such form is the Occupy Wall Street movement, with its deep-seated distrust of banks and corporate bailouts. But while OWS may get the headlines, cyber-enthusiasts have found their own way to protest against the monopoly over money held by bankers and the government. It’s called Bitcoin.

In place of “In God We Trust,” this new digital currency might as well bear the slogan “In Algorithms We Trust.” Man may be corruptible, but math is pristine, argue the Bitcoin enthusiasts. It’s a currency minted on hope and rebellion, and forged in the aftershocks of the massive 2008 bailouts. No less than the OWS crowd, these Bitcoin enthusiasts, most of them just as young and restless, aspire to wrest power from the establishment and hand it over to the “99%.” That’s the backdrop that explains the Bitcoin phenomenon. And the value of the Bitcoin has been rising ever since its introduction in 2009.

On one hand, Bitcoin is an important milestone on the long road that is the abstraction of money, value, and currency. On the other, it is yet another mathematical product whose security depends on the dubious proposition that no hacker will ever be found who is more clever than the product’s creator.

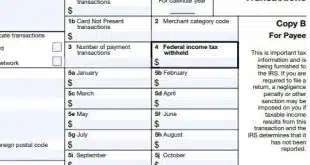

First, there’s the matter of Bitcoin’s importance. We replaced barter with precious metals by weight, then we moved up to counting minted gold coins before we learned to stuff our wallets with paper. The next step is inevitable: money as a string of bits. Such a string can be flipped from anonymous cash to owner-secured wealth, from redeem-anywhere to “transact only between designated payer and payee,” from pay any time to pay no later than.

Bit-wise money will revolutionize payments, overhaul banking, revitalize taxation, replace today’s aging credit business, open dramatic new avenues for risk management, and, most important, bit-wise currency will boost innovation and productivity, and lift up global prosperity.

The significance of Bitcoin is in its lessons. The world is ready for bit-wise money. We are okay with carrying our wealth in our phone (secure as travelers checks), paying cash-like, enabling micropayment, avoiding complex settlement cycles. We are eager to employ near-field communication (NFC) to pay for our shoes and meals, and anxious to leverage the global village for international money transfer. The underlying idea of Bitcoin, much like the idea behind the earlier attempt at such currency (DigiCash), is to change today’s paradigm where computers and phones point to accounts in the cloud, and money moves from one account to the other.

Bit-wise money will enable direct payment as the bits whisk from the payer’s personal electronic device to the payee’s PED. Underdeveloped countries will leverage bit-wise virtual banking, and exercise bit-money credit distribution. That’s the revolution for which Bitcoin is a mid-step.

But when our clients inquire, we say: “You don’t want to gamble your wealth on a hackable algorithm.” The cyber-rebels are right—algorithms can’t be corrupted. But all our mainstay ciphers today (including the algorithms used by Bitcoin) are based on an obscure notion known as “mathematical intractability.” It is this intractability that underwrites the security and integrity of Bitcoin. What Bitcoin adherents conveniently ignore is the fact that the intractability of crypto-algorithms erodes, and the more an algorithm is used, the faster its intractability vanishes. And when it does, it is like being visited by Bonnie and Clyde.

As money climbed on the ladder of abstraction, each level was derived from its predecessor. The current coins and paper bills were first minted as promissory notes to pay gold to the bearer. The post-Bitcoin bit currency will commence as a commitment to exchange the bit string against dollars, or Euros, and only in the long run assume currency independence.

The post-Bitcoin solution cannot be vulnerable to fast-eroding mathematical intractability, and cannot position itself on a collision course with central banks and national governments. The eventual, durable solution cannot rely on mathematical complexity. You don’t need to be an Einstein to reason that what one cyber-genius can build, another cyber-genius can compromise. An underlying foundation of conceptual simplicity is required to build the trust of the street.

What you can safely bet on is that innovation will fulfill this spec. The financial bit-bang is about to happen.