Ever since banks, merchants, and tech companies first introduced mobile services, they’ve looked for ways to entice more usage by streamlining the way consumers interact with little screens. Now Wells Fargo & Co. has decided to put frequently used payments services on the home screen of its mobile app, before the customer signs in. The bank claims nearly 22 million users for the app.

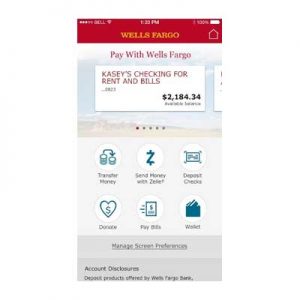

The new feature, called “Pay With Wells Fargo,” shows immediate links to the peer-to-peer payments service Zelle, various mobile wallets, remote deposit capture, money transfers, and an access code for cardless ATM transactions. “Mobile usage data shows that these are the mobile-payments features Wells Fargo customers use most often,” the bank said Thursday in a news release.

Wells says its transaction volume on Zelle, which is controlled by many of the nation’s largest banks, has risen 64% since the service officially launched 11 months ago. Average transaction volume per active user has increased 19%. The bank did not release actual figures. Previously, the service had been offered under the name clearXchange. As for the access codes, customers use more than 1 million each month for ATM transactions, the bank said.

Pay With Wells Fargo will include more services in the future, the bank said, again based on customer usage patterns. “Pay With Wells Fargo is the first phase of a longer-term reinvention of Wells Fargo’s mobile-banking experience,” the news release says. The new approach is being officially unveiled Thursday at an Investor Day conference.

A number of companies and networks in recent months have moved to simplify consumer interactions online and on mobile devices. Perhaps the biggest example is the so-called common pay button the major card networks are developing for e-commerce sites, based on a security specification developed by EMVCo, the standards body controlled by six major international payments networks.