The major U.S. payment card networks have been trying to set up shop to process domestic transactions in mainland China for years, only to encounter government resistance. But American Express Co. announced a breakthrough Friday with a deal to become the first overseas network to win an OK to operate in China.

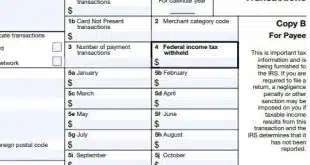

AmEx received from the People’s Bank of China a so-called preparatory approval for a clearing-and-settlement license, the New York City-based card company said. The company also said it entered a joint venture with a Chinese financial-technology company, Lianlian Yintong Electronic Payment Co. Ltd., to process domestic transactions on AmEx cards.

China offers a massive payments market that includes a well-developed mobile-payments infrastructure dominated by the Chinese tech firms Alipay and WeChat. Mobile payments alone totaled $5.5 trillion in China in 2017, according to an estimate by Mercator Advisory Group, Maynard, Mass. While Visa Inc., Mastercard Inc., and AmEx have been jockeying to win a piece of that business over the years, a hopeful sign emerged late in 2017 when Chinese authorities released details on how foreign firms could apply for domestic clearing licenses. All three U.S. networks applied. The Shanghai-based card network UnionPay International, which emerged in 2002, dominates domestic card-based payments and has set up operations abroad, including in the United States.

The joint venture with Lianlian Yintong, also known as Lianlian Pay, will be known as Express (Hangzhou) Technology Services Co. and will be responsible for clearing and settling domestic transactions on AmEx cards, according to AmEx’s announcement. “What is big here is that Express can operate without the help of a third-party partner,” says Brian Riley, director of the credit advisory service at Mercator, in an email message. “The big deal is that this provides the opportunity for American Express to process in the native currency rather than filtering transactions through UnionPay. In this case, [the] Express network can process transactions directly. Other approvals are necessary to be fully functional, but for now, this is a large step.”

Lianlian is a 15-year old nonbank payments network and a longtime AmEx partner. The company says it has established connections with all of China’s major banks. Amazon.com Inc. and eBay Inc. are among the online marketplaces for which it supports payments.