In its latest move to enhance its electronic bill-payment services, Mastercard Inc. announced Friday it has a deal to acquire bill-pay platform provider Transactis Inc.

New York City-based Transactis provides technology that enables small businesses and organizations such as schools and property owners that mostly deal with paper bills and checks to support online bill pay, according to Mastercard. Transactis’s distributors or partners include a number of banks and payments companies, including Worldpay Inc., PNC Bank, and Capital One.

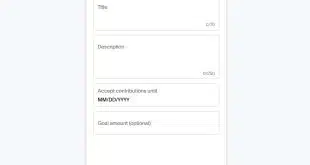

With Transactis, Mastercard says it will be able to support bill payments in online bank applications as well as in biller Web sites with enhanced end-user interfaces, expanded payment options, and digital bill-presentment capabilities.

“Transactis’s technical and commercial know-how, combined with our reach and comprehensive payment options, will greatly simplify the entire process,” Colleen Taylor, Mastercard’s executive vice president of new payment platforms, North America, said in a news release. “We’ll be able to deliver a better real-time consumer experience, from signup to viewing and paying bills, leveraging the investments that have been made in the core infrastructure.”

Transactis chief executive Joe Proto said in the release that “Mastercard has been a great partner and pushed the industry forward in this space. Historically, neither the bank bill-pay nor biller-direct model [has] delivered the ideal experience or the complete solution. We see this as a unique opportunity to bring our complementary technologies together to deliver a better bill-pay experience, accelerating the migration of paper bill and checks to these online channels.”

Payments consultant and researcher Patricia Hewitt of Savannah, Ga.-based PG Research & Advisory services says “the key value message here is ‘real-time.’”

“We know that younger consumers prefer biller-direct payments, and financial institutions are struggling with getting them to use online-banking bill pay,” Hewitt tells Digital Transactions News by email. “If Mastercard can crack that code and leverage this technology to shift this paradigm by allowing a bank to act as a conduit to more real-time payments, it would be a big win. If nothing else, this gets them some proven fintech for billers and commercial entities, a really hot part of the market right now.”

Terms of the deal, which Mastercard expects to close by June 30, were not disclosed. The new Bill Pay Exchange should be fully rolled out later this year, according to Mastercard.