PayPal Holdings Inc. is raising its online merchant rates in the midst of a boom in e-commerce but also reducing some fees as it keeps a wary eye on rivals such as Square Inc. and Stripe Inc. The new rates, which PayPal announced Friday, cover a sweeping range of transaction types and will take effect Aug. 2.

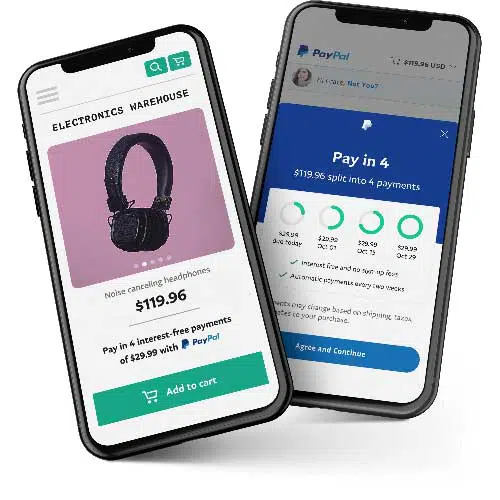

The big change is coming in PayPal’s pricing for online payments, for which it will start charging 3.49% plus 49 cents per transaction, up from its long-time pricing of 2.9% plus 30 cents. The new rate applies to transactions on PayPal Checkout as well as on such services as the increasingly popular Pay With Venmo option and the new Pay in 4 installment service.

Other pricing remains unchanged or is being reduced. For example, the rates for the new QR-code option, which PayPal introduced last year for in-store payments, remain unchanged at 1.9% plus a nickel above $10 and 2.4% plus a dime for transactions at $10 and under. And the rate for credit and debit card processing will decrease, to 2.59%, though the fixed fee rises to 49 cents. Formerly, these transactions carried PayPal’s standard rate of 2.9% plus 30 cents.

The notable rise in online pricing comes as PayPal’s overall transaction volume is booming. Volume reached $285 billion in the first quarter, putting the company on a $1 trillion annual rate. The company reached 392 million accounts by the end of the quarter, up 21%, including 31 million merchants.

At the same time, e-commerce has shot skyward as consumers have stayed home during the pandemic and shops have closed. The U.S. Census Bureau estimated e-commerce sales in the first quarter reached $215 billion, up 39% year-over-year. Some experts predict much of the momentum will remain as consumers return to work and stores re-open.