American Express Co. reported strong results Friday morning for its third quarter as its top executive said the company hasn’t exhausted its interest in acquisitions, though he added the New York City-based payments company is cool to the prospects for cryptocurrency as a medium of exchange.

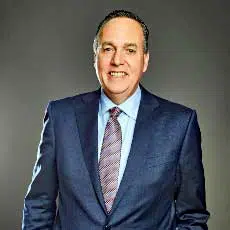

Chief executive Stephen Squeri added that while AmEx is watching the growing industry interest in buy now, pay later options, he doesn’t view the trend as a threat to consumer spending via AmEx products.

With its strong reliance on travel-and-entertainment spending, AmEx was battered by the pandemic, but in the latest quarter volume in this key segment continued a recent upward trend. Restaurant spending, in particular, showed strength, with spending up 68% year-over-year and up 4% compared to the same period in 2019. Other T&E categories, while still negative compared to two years ago, were all up more than 100% versus a year ago, according to information the company released Friday.

Overall, consumer T&E spending was down 26% compared to the third quarter of 2019. Consumer-based volume across all categories totaled $153 billion in the quarter, with 26% of that volume coming from T&E, the company reported.

AmEx hasn’t hesitated in recent years to buy fintechs where it sees a strategic fit, with perhaps its acquisition of Kabbage last year representing its biggest deal in recent years. With technology from that acquisition, which reportedly amounted to as much as $850 million, AmEx this summer introduced a checking account for small businesses.

But Squeri on Friday indicated his company will be choosey when it comes to further deals. “We’re constantly looking at those bolt-on acquisition [possibilities],” he told equity analysts on the earnings call. But many fintechs now are “highly valued,” he added, and “the math doesn’t make sense.” The company’s venture arm, AmEx Ventures, maintains investments in more than 40 companies and serves as a “feeding system” for potential acquisitions, he added.

On the growing popularity of BNPL, Squeri was equally sanguine. The option, which allows consumers shopping online or in stores to split transactions into three or four equal installments without interest, has picked up momentum in recent months in the wake of the pandemic. AmEx offers a competing service called Pay It Plan It, which Squeri said is in its “early stages.”

“BNPL is not a big competitive threat to us,” Squeri said. “It tends to be targeted at low FICO [scores] and at a lot of debit card users. Our charge card gives you more float and more rewards.” FICO scores are used by credit grantors to measure the likelihood that loans will be repaid timely.

Nor does Squeri see high prospects for cryptocurrency, at least in the near term, despite recent growth of interest in the digital money. Both Mastercard Inc. and Visa Inc. have recently built network capabilities to handle crypto. “I don’t see any point where crypto is going to be a threat to card payments,” he told the analysts. He cited an absence with cryptocurrency of features such as the ability for users to dispute transactions and for companies to extend credit. Still, he added “there is a role for digital currency. It can make cross-borders payments a lot more seamless.”

With its ongoing recovery from the impact of the pandemic on its key travel market, AmEx reported total revenue for the quarter of $10.93 billion, up 25% year-over-year and down 1% over the same period in 2019. Discount revenue, at 61% of total revenue, came to $6.68 billion, up 34% year-over-year and 2% from 2019’s third quarter.