Paysafe Ltd. early Wednesday reported progress in turning around its beleaguered digital-wallet business, noting a crucial deal with the world’s largest cryptocurrency exchange and progress in its key iGaming market.

As part of an effort to reinvigorate its wallets, “We’re starting to work with crypto exchanges” more actively, Philip McHugh, Paysafe’s chief executive, told equity analysts in a call to discuss the London-based company’s fourth-quarter and full-year 2021 results. That effort so far includes a deal with Binance, by far the world’s biggest exchange, to support crypto trading via Paysafe wallets in the United States and the United Kingdom. Binance supported $18.7 billion in 24-hour volume as of early morning Wednesday, according to Coinmarketcap.

McHugh expects such deals will be replicated with other exchanges as well. “We see virtual currency as a megatrend. It will change the way e-commerce works,” he said, adding, “Paysafe is uniquely positioned for this.” For Binance, Paysafe has white-labeled its wallet, allowing Binance users to buy crypto on the exchange and store it via a single application programming interface. “We’re seeing interest in a white-labeled wallet in other industries as well,” McHugh said.

The big move into crypto follows a third quarter last year in which Paysafe’s digital-wallet business, chiefly its Skrill and Neteller products, saw its volume come to just shy of $4 billion, down 15% from the second quarter and off 17% from the same period in 2020. The wallets, which are also deployed for iGaming clients, account for about 13% of the company’s revenue. A big part of the problem consisted of new regulations in the company’s German and Dutch markets that impacted users’ ability to deploy their wallets for iGaming. Paysafe has 3.1 million active users for its wallets. On the other hand, Paysafe reported progress in North American iGaming, where the company is now live in 21 states and volumes tripled in the fourth quarter compared to the third. Online gambling and sports betting are generally known as iGaming.

For all of 2021, volume in the wallet segment dropped 16% compared to 2020, to $17.2 billion. Volume in the quarter fell 19% year-over-year, to $3.9 billion. Acknowledging “digital-wallet headwinds,” McHugh said the business “had become too complex over time.” Now, he said, the Paysafe is “making strong progress” with a turnaround effort. “The results are starting to show,” he added, particularly in the crucial sports-betting market and with a “revamp” of the Skrill wallet.

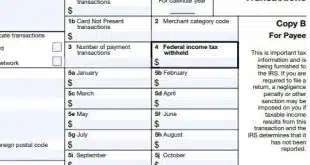

Paysafe’s acquiring business in the U.S. market, however, is showing strong growth, with $78 billion in volume last year, up 35%. This reflects a mix of one-third card-not-present volume and two-thirds card-present, the company said.

For the quarter, Paysafe recorded $31.5 billion in volume, up 20% year-over-year, as its processing business offset its decline in wallet volume. Revenue came to $371.7 million, flat with the same period in 2020. For all of 2021, volume was up 22% over 2020, totaling $122.4 billion. Revenue was $1.49 billion, up 4%, despite an 8% drop in digital-wallet revenue.

Paysafe also announced William Foley, who has served as chairman of Paysafe since the company’s move to go public last year via a merger with a special purpose acquisition company, has stepped down from that role. He has been replaced by Dan Henson, a former General Electric executive.