Central bank digital currencies are still a relatively new payment method around the world, but now they’re starting to address the issue of user authentication, and at least one is doing it with facial-recognition technology. PopID Inc. on Thursday announced holders of the Bahamian Sand Dollar, one of the first CBDCs to emerge for general use, will use PopID’s PopPay platform to authenticate themselves.

The new service relies on the SunCash digital wallet, which users can link to PopPay. This will allow users to spend Sand Dollars at merchants accepting SunCash, proving their identity with a facial scan. SunCash is said to have more than 55,000 active wallet holders, or about one-seventh of the population of the Bahamas. More than 1,000 merchants accept the wallet.

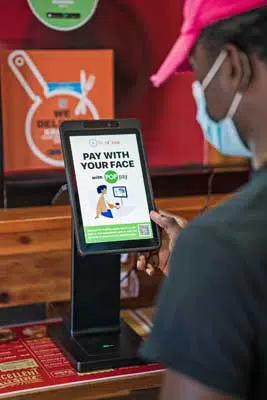

PopID’s technology allows merchants to verify customers’ identity with a facial scan. The technology links any payment method, including cards or direct bank transfers, and digital currencies, to the user’s unique facial characteristics.

“We applaud SunCash for its deployment of this solution that allows Bahamians to transact in Sand Dollar using only their face,” said John Rolle, governor of the central Bank of The Bahamas, in a statement. “Such security features are important to increasing personal comfort around the use of digital payments and advancing the Central Bank’s goal of increasing financial inclusion among all segments of our society.”

A total of 91 nations have at least investigated CBDCs, while nine have launched one, according to the Atlantic Council. Another 15 are testing one in a pilot. Central bank digital currencies are digital versions of national currencies. They are issued and backed by a nation’s banking authority.

One of the putative benefits of the currency is said to be financial inclusion, particularly for countries where cash is predominant. “With governments around the world increasingly implementing CBDCs to replace physical cash, PopPay serves the critical policy objective of ensuring that all people can transact with the currency,” said John Miller, chief executive of Los Angeles-based PopID, in a statement. Miller is also chairman of PopID’s holding company, Cali Group.

Facial-recognition technology is gaining increasing interest among payments companies generally. Last week, Google Inc. announced users of the new version of the Google Wallet could use facial recognition as a verification option to initiate a payment from a digitized card. Other options are a PIN or a fingerprint.