Intuit Inc.’s announcement on Tuesday that it has integrated its GoPayment mobile-payment processing application with its QuickBooks Point of Sale 2013 software is expected to make GoPayments more appealing to small businesses than rival products from the likes of Square Inc. and PayPal Inc.

Earlier this week, Square announced that its card reader is available at more than 20,000 retail locations nationwide, including Walgreens, Staples Inc., and FedEx Office stores.

“The move creates a lot of cross-selling opportunities for Intuit with their existing clients,” says Aaron McPherson, practice director for Framingham, Mass.-based IDC Financial Insights. “With Square expanding its retail presence and its interface slicker and easier to use, it has a larger mind share.”

MountainView, Calif-based Intuit has 200,000 retailers servicing 23 million customers with GoPayment and QuickBooks Point of Sale. Those retailers generate about $6 billion in transaction volume processed though Intuit annually. Overall, Intuit has about 8 million small-business customers.

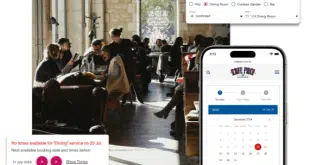

Small merchants can use the integrated GoPayment/QuickBooks Point of Sale solution to perform a number of back-office functions such as managing inventory in real-time across all their stores, setting automatic re-order thresholds for inventory, tracking employee time and attendance, tracking customer purchase history, and accessing performance reports for up to 20 stores through a smart phone or POS terminal.

“In the past, small merchants could not combine their mobile payments platform with their traditional [point-of-sale] software. Integrating GoPayments and QuickBooks Point-of-Sale blends those two applications into one solution,” says Trevor Dryer, head of product management, mobile payments and point-of-sale for Intuit’s Payment Solutions division.

Intuit has also simplified the user interface on the GoPayment app to mirror the workflows on QuickBooks Point of Sale. The new interface is more user- friendly, making it easier for merchants to ring up sales and drill down into reports and data gathered by the program.

Future enhancements to the integrated solution include loyalty and rewards applications that merchants can use to customize offers and coupons for their customers based on their purchase history. “Personalization enhances the interaction between the customer and the merchant,” says Dryer.

Plans are also in the works to develop consumer applications that can integrate with QuickBooks POS and GoPayment for use on smart phones and tablet computers, Dryer adds without being more specific.

“This is a solution that gives micro-merchants a more robust payment solution they can use to effectively manage their business as it grows and that Intuit can use to move them into a more traditional acquiring relationship,” says Rick Olgesby, a senior analyst for Boston-based Aite Group. “Acquiring is becoming more and more about offering comprehensive POS solutions.”

Recognizing that QuickBooks Point of Sale’s base price of $1,100 might send some micro-merchants into sticker shock, Dryer says Intuit is considering subscription-based pricing. “We have two camps among our target audience, those that want to pay a one-time fee and those that want to spread the cost out through subscription pricing,” he says. “We are looking at the latter too.”

Offering subscription-based pricing is expected to help attract new customers, as many small and micro-merchants prefer to avoid large upfront costs for new technology, according to Olgesby. “A lot of these merchants would rather put large lump sums into their business,” he says.