Airbnb Expands Reserve Now, Pay Later Globally

Airbnb Inc. has expanded its Reserve Now, Pay Later booking option worldwide. The service enables travelers to reserve properties and ...

A Global Survey Uncovers a Strong Following for Stablecoins

Research released early Tuesday argues stablecoins have made their move out of niche applications and into the mainstream of international ...

Can/Am’s Teller Payments and other Digital Transactions News briefs from 2/17/26

Can/Am Technologies Inc. has introduced Teller Payments, aimed at helping state, local, and education agencies process payments within Can/Am’s Teller Government ...

Japanese Fintech PayPay Looks to Enter the U.S. Via a Visa Partnership And an IPO

Japanese fintech PayPay Corp. is preparing a push into the United States through a partnership with Visa Inc. and an ...

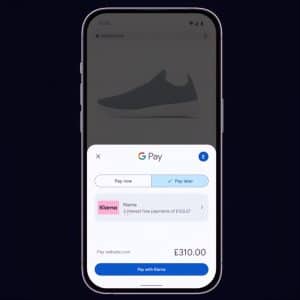

A Rapidly Growing Klarna Joins Google Pay in the U.K.

Klarna AB announced early Monday its pay-over-time service has become an available payment option in Google Pay in the United ...

Hoot Host’s Launch and other Digital Transactions News briefs from 2/16/26

Hoot Host launched an expanded version of its software-with-a-service product for online businesses, including payments acceptance through PayPal, Square, and Stripe ...

Fiserv Launches INDX for Real Time Settlement of Digital Assets in U.S. Dollars

Fiserv Inc. has launched INDX, a real-time cash-settlement platform that enables digital-asset companies to store and transfer U.S. dollars at ...

How Chip Cards Have Been Deployed to Battle Fraud in State EBT Programs

Chip cards are coming to state benefit programs, with the latest development emerging from Alabama. The state’s Department of Human ...