The volume of buy now, pay later loans in the U.S. market will total $1.92 billion this year, up 25% from $1.54 billion in 2021, according to research from Research and Markets. The report projects the market will hit $6.5 billion by 2027.

Read More »Search Results for:

Consumers’ Ailing Financial Health Could Cast a Shadow Over the Holiday Shopping Season

As the holiday shopping season heads into the home stretch, consumer concerns over withered buying power due to inflation is expected to tamp down overall spending, according to J.D. Power’s Banking and Payments Intelligence Report. In a November survey of 4,000 retail bank customers nationwide, 40% said they expect to …

Read More »Payments Veteran Bisignano Signs on As Fiserv Chairman and CEO for Another Five Years

Long-time payments executive Frank Bisignano, who has guided payments giant Fiserv Inc. through a tumultuous time in the payments industry, has signed on to lead the company for another five years. Bisignano became chairman of the Brookfield, Wis.-based company in May, following his appointment as chief executive in July 2020. …

Read More »Crime Ring Targets Online Retailers And Other Digital Transactions News briefs from 12/22/22

A fraud ring that appears to be based in Southeast Asia is targeting U.S. retailers and has already committed an estimated $660 million in fraud in stolen laptops, cell phones, computer chips, gaming devices, and other goods just in November, said Signifyd, an online-fraud prevention firm. Signifyd said it has been tracking …

Read More »4 benefits of integrating payments with your software solution

Steven Velasquez, Senior Vice President and Head of Partner Business Development – Elavon As the worlds of technology and financial services converge, providing your merchants and their end users with a connected buying experience is crucial to differentiating your software in an increasingly crowded and competitive market. ISVs are now …

Read More »Paya Partners With 1Retail to Bring Integrated Payments to Small Businesses

Payments provider Paya Inc. has agreed to supply point-of-sale systems supplier 1Retail with technology that enables EMV contactless and stored payments in enterprise resource planning (ERP) software from Acumatica Cloud. The deal provides Paya’s and 1Retail’s mutual customers running the Acumatica ERP platform with a POS system that works in …

Read More »Fraud on P2P Networks Hits 12% of Bank Customers in the U.S., J.D. Power Finds

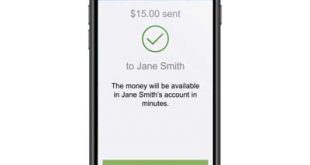

Some 12% of U.S. customers have lost money to fraud on a peer-to-peer payment network, while 11% have seen it happen to a family member, according to survey results released earlier this month by J.D. Power. The networks cited by the respondents were Zelle, Venmo, and PayPal. For the survey, …

Read More »Mechanics Adopts Finastra RTP Service And Other Digital Transactions News briefs from 12/21/22

Payments-technology provider Finastra said Mechanics Cooperative Bank, a financial institution with $645 million in assets, has adopted the Finastra Payments To Go platform to offer real-time payments via The Clearing House Payments Co. LLC and later through the Federal Reserve’s FedNow network. Digital-security provider IronVest Inc. launched what it calls a “super app” for …

Read More »Worldline Adds Splitit as a BNPL Option for Merchants

Global processor Worldline S.A. will make Splitit, a white-label buy now, pay later provider, available to its roster of merchants and marketplaces, starting first in North America. Announced Tuesday, the integration will enable Worldline merchants to offer card-based installment payments within the existing checkout flow. Merchants can use their brand …

Read More »Study: Peer-to-Peer Payments Are Key To Financial Institutions’ Payment Strategies

As financial institutions look to revamp their payment strategies, peer-to-peer payments are expected to play a key role, says a report from Cornerstone Advisors. During the past three years, nearly 30% of community-based financial institutions have replaced their P2P service or selected a new one, and about one in five …

Read More »CFPB Fines Wells $3.7 Billion And Other Digital Transactions News briefs from 12/20/22

The Consumer Financial Protection Bureau has ordered Wells Fargo Bank to pay $3.7 billion, including a $1.7-billon civil penalty and $2 billion in redress to consumers, for what the bureau says were illegal fees and interest charges on auto and mortgage loans, incorrect charges on checking and savings accounts, and other “incorrect” …

Read More »Zelle Users Are More Profitable for Financial Institutions, says an Early Warning Study

Customers new to using Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, have higher levels of engagement with their financial institutions than customers not using Zelle. That’s according to a recent study conducted by Early Warning and Curinos, a provider of data and technology technologies to financial …

Read More »COMMENTARY: Apple Pay Later Is Set to Trigger a Domino Effect in the BNPL World

The interest in buy now, pay later (BNPL) skyrocketed in 2021 and 2022: Millions of people have turned to this installment-payment solution for its convenience, flexibility, and simplicity. So it’s no surprise that Apple announced its new BNPL product, Apple Pay Later, in June. With its new financial service, the …

Read More »Wedge Joins Fiserv AppMarket And Other Digital Transactions News briefs from 12/19/22

Wedge Financial Inc. said its app, which lets users spend funds from multiple fiat accounts and assets using a single card, has joined Fiserv Inc.’s AppMarket. Work at the New York Fed under an initiative called “Project Cedar” means the United States has officially moved from the “research” phase to the …

Read More »Mobile Fuel Service EzFill Adds a One-Time Payment Service

EzFill Holdings Inc.’s specialty is sending one of its mobile fuel trucks to a driver’s location, thus eliminating the hassle to the driver of having to get to a gas station to fill up the car or a fleet of vehicles. Now, EzFill has launched a new one-time payment service …

Read More »Sightline Payments Signs up Parx Casino for Wallet-Based Gambling Resortwide

Merchants of all sorts found themselves converting to digital payments acceptance over the past two years in the face of the pandemic, but one niche in particular has offered a fertile field for merchant acquirers: casinos. Online and on-premise gambling has attracted payments providers large and small, including specialists like …

Read More »Dealer Pay Joins CDK Program And Other Digital Transactions News briefs from 12/16/22

Dealer Pay, a provider of point-of-sale payment acceptance for auto and truck dealerships, said it has joined the CDK Global Partner Program, which features applications and integrations for automotive dealers. Mastercard Inc. is working with the U.S. International Development Finance Corporation to help support financial institutions and businesses that work with …

Read More »No Slowdown for Record-Breaking Phishing Attacks

Phishing attacks continue to set record highs. The third quarter of 2022 was the highest quarter on record for number of attacks, according to the latest Anti-Phishing Working Group’s Phishing Activity Trends report, released Wednesday. The APWG observed 1,270,883 phishing attacks during the September quarter, up 16% from a then-record …

Read More »An FIS Board Shakeup Arrives As the Processor Begins a Wholesale Company Review

FIS Inc., one of the world’s largest payment processors, is undergoing more changes at the top. Jacksonville, Fla.-based FIS will replace its existing board structure, where Gary A. Norcross, chief executive, also was board chairman, with an independent director as the chair beginning Dec. 16. Replacing him as chairman is …

Read More »Afterpay Most Used BNPL Option by Gen Z And Other Digital Transactions News briefs from 12/15/22

Afterpay, the buy now, pay later service owned by Block Inc.’s Square, is the one most used by Gen Z consumers—those between 18 and 25 years old—according to a survey from Insights in Marketing, a marketing consultancy, with 58% of them having used Afterpay. Next was Klarna at 44%; Affirm …

Read More »