Because of the efficiency, savings, and convenience they bring to a system traditionally choked with paper, debit cards linked to flexible-spending accounts (FSAs) are turning into a hot growth market in electronic payments. Issuers will put 6 million of the cards in circulation in 2006, up 50% over last year and 3.5 times greater than the number issued in 2004, according to a research report issued this week by Celent LLC, Boston. The cards, which allow employees to electronically access funds set aside for health-care costs, have breathed new life into the FSA market and represent a major opportunity for banks and merchants to capture more interchange and sales income, the report points out. At the same time, says the report, the cards face significant challenges when it comes to satisfying Internal Revenue Service rules on allowable purchases and in employee education. The Celent report, entitled “Flexible Spending Accounts, Flexible Cards?” forecasts that the penetration of cards in the FSA market, which stood at 20% of accounts in 2005, will exceed 80% by 2010 as more employers offer them and employees respond to the convenience of using them rather than filing paperwork for reimbursement. The total number of FSA accounts, however, will begin to drop after 2007 because of competition from other health-care accounts, including health-reimbursement accounts (HRAs) and health-savings accounts (HSAs). FSAs in 2005 accounted for 88% of this market, or some 16.8 million accounts (a single account can have more than one card linked to it). FSA debit cards, which are signature-debit plastics branded by the bank card associations and operating on their networks, lift the average deposit employees put in their accounts by as much as 30%, according to estimates cited in the report. The average for all FSAs now is $1,200, for a total market size of $21.8 billion. This market lift from cards presents a big opportunity for both issuers and merchants. “Thus lies the opportunity for any issuers looking to capture revenue via interchange..and for merchants, such as pharmacy chains and grocery stores, to capture a portion of this [point-of-sale] opportunity,” writes Celent analyst Ariana-Michele Moore, author of the report. But hurdles remain, in particular the need for increased rates of electronic substantiation of purchases to satisfy IRS rules. Without such substantiation, employees need to file receipts and other paperwork to prove the transactions were covered. Currently, processors are able to capture enough data to substantiate more than 70% of card transactions, “though these substantiation rates will vary according to the card provider and the relationships it has in the market,” says the report. Another issue lies in employee education, particularly regarding the need to hold on to receipts in case purchases can't be electronically verified. In the early days of FSA card programs, Moore writes, many employees threw away their receipts, wrongly assuming the card automatically verified their transactions, and were “outraged” to find they needed them later. New features program administrators are considering for FSA debit cards include the ability to draw from more than one account with one card, credit lines for transactions that exceed the value in accounts or don't meet qualification criteria, and rewards programs that promote wellness, according to the report.

Check Also

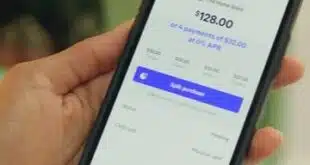

Affirm Expands Its Credit Reporting to TransUnion

Buy now, pay later platform Affirm Holdings Inc. early Tuesday announced it will begin credit …