With three processor megamergers having closed in 2019, the value of firms involved in handling and managing electronic payments has seldom been clearer. But further evidence emerged this week with news of Stripe Inc.’s latest funding round, which valued the San Francisco-based payments-technology company at fully $35 billion. Indeed, at a stroke, the $250-million round has catapulted 10-year-old Stripe into the ranks of the country’s largest payments firms by market valuation.

Stripe remains privately held. But compared to the valuations of publicly held payments companies, it now ranks ninth, just behind Shopify Inc., which checks in at $37 billion, and ahead of Discover Financial Services ($26 billion), according to an analysis by Digital Transactions News.

This week, Global Payments Inc., now valued at $48.8 billion, swallowed the big processor Total System Services Inc. at a $21.5-billion price tag. Earlier, Fiserv Inc. acquired First Data Corp. for $22 billion, and Fidelity National Information Services Inc. shelled out $43 billion to buy Worldpay Inc.

Stripe, which started out supplying simple lines of code to help small e-commerce merchants accept card payments, has expanded its product base rapidly in recent months to embrace merchant cash advances, its own corporate card, instant payouts, and the physical point of sale through its own software and devices. Its move to the physical world was aided by its 2018 acquisition of a startup called Index Inc., which made its mark with technology that speeds up EMV card transactions.

With assets in both acquiring and issuing, Stripe is likely to reap dividends, observers say. “If you can create an ecosystem in which you’re engaging on both sides of the network, there should be powerful monetization synergies,” notes Eric Grover, principal at Intrepid Ventures, a Minden, Nev.-based financial-services consultancy.

Others agree, and expect Stripe to use its latest funding to support its ambitions across payments. “Stripe is trying to become that unified commerce provider across various channels including [e-commerce] and physical environments, so they will also have a focus on building or developing new products that can bridge that gap for them, in a more meaningful way,” says Jared Drieling, senior director of business intelligence at The Strawhecker Group, an Omaha, Neb.-based payments consultancy.

The company has always played it close to the vest with numbers on its processing business. In a blog post Thursday about the latest funding round, Stripe simply said it processes “hundreds of billions of dollars a year for millions of businesses worldwide.” But it is clearly moving beyond its core client base of small sellers. “[C]omplex international enterprises are increasingly trusting Stripe with core payment processing,” Stripe says in its blog post.

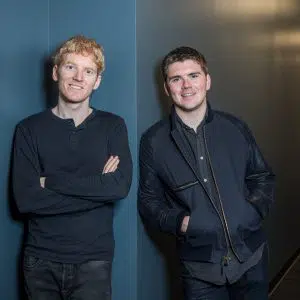

But investors—including General Catalyst, Sequoia, and Andreesen Horowitz, all of which participated in the latest round—now are likely betting on the come. John Collison, president and co-founder of Stripe, is quoted in the blog post pointing out that “less than 8% of commerce happens online,” a point the company clearly feels leaves open vast potential in e-commerce processing. “We’re investing now to build the infrastructure that’ll power internet commerce in 2030 and beyond,” Collison said.

Whether or not it can carve out a fair share of that potential volume for itself, payments-industry observers are already as impressed with its performance as investors appear to be, particularly in contrast to its larger rivals. “Stripe’s been nimbler than the payments giants and a relentless payments innovator, enhancing rather than attempting to upend the existing ecosystem,” says Grover.