Soon, there might be just two states that prohibit credit card surcharging with the passage Tuesday of a bill in Colorado that would permit the pricing strategy. The bill, SB21-091, passed both the Colorado House and Senate and now moves to Governor Jared Polis’s desk. He has 30 days to sign it. If signed into law, only Connecticut and Massachusetts would still prohibit credit card surcharging.

Earlier this year, a surcharging ban in Kansas was struck down after CardX LLC, a surcharging-services provider, filed suit against it. CardX also lobbied in support of the Colorado measure.

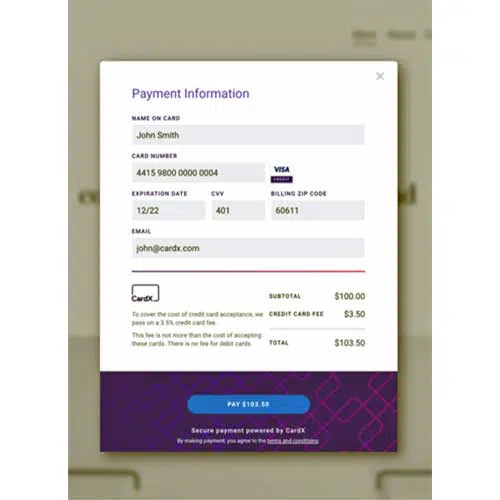

Chicago-based CardX calls the Colorado bill “the most pro-consumer surcharging regime in the country. This bill requires Colorado-specific consumer disclosure language, permits surcharge amounts only up to the level the merchant pays their provider for processing (ensuring surcharges are not profit centers to merchants), and prohibits surcharging on debit cards,” Jonathan Razi, CardX chief executive, says in an email to Digital Transactions News. If signed into law, the bill will take effect July 1, 2022.

“As surcharging becomes available in more jurisdictions, we’re seeing a shift to more prescriptive surcharging law—lawmakers want to permit surcharging, but define affirmative requirements for surcharging ‘the right way,’” Razi says. “This points to an important role for CardX’s advocacy going forward, helping to inform lawmakers and attorneys general about merchant needs and payments industry regulations so lawmakers can develop a balanced, pro-consumer, pro-market framework that harmonizes with surcharging best practices nationally. SB21-091 has not only achieved this, but done so with flying colors.”

U.S. card brands revised their rules in 2013 to allow surcharging only on credit card transactions as part of a credit card interchange settlement reached in 2012, though the revision carried restrictions and many state bans remained in place.