Buy now, pay later provider Affirm Holdings Inc. has expanded its payment options to include Pay in 2 and Pay in 30.

The new BNPL options are intended to provide consumers with more flexibility in budgeting their monthly income, the company says. Data from the Bureau of Labor Statistics shows that 19.8% of nonfarm payroll employees get paid semi-monthly and 10.3% get paid monthly.

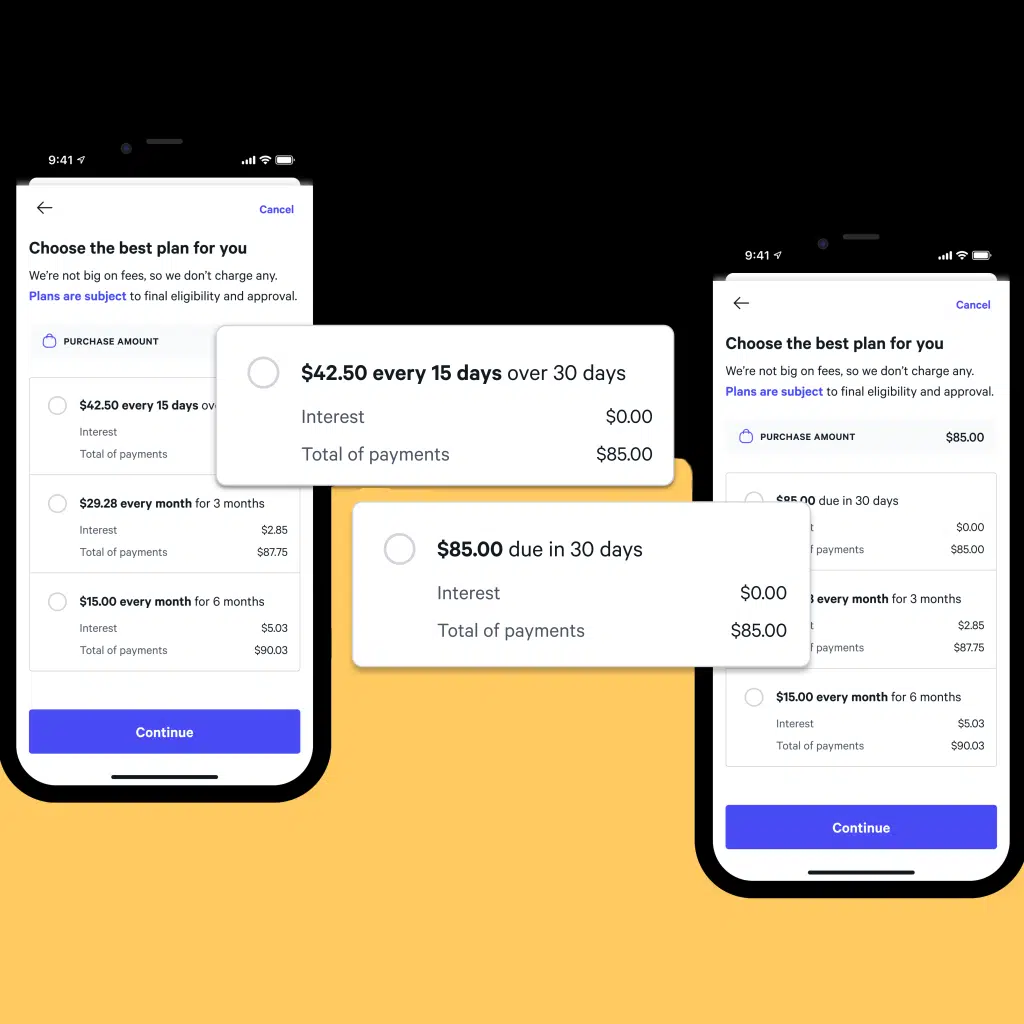

Pay in 2 allows consumers to split the cost of a purchase into two no-interest monthly payments, while Pay in 30 allows consumers to pay their balance in full, interest-free, within 30 days of their purchase.

During testing of the new payment options, conversion rates among e-commerce shoppers increased, Affirm adds. The company plans to begin rolling out the new payment options in the coming months.

The addition of the options coincides with Affirm’s strategy of expanding beyond its Pay in 4 model to become a more attractive payment option to consumers. “We’re not going to be constrained by Pay in 4 or pay on a monthly schedule,” Affirm chief executive Max Levchin said while outlining the strategy at Affirms annual investor day in November. “We want to be relevant to every transaction, not just Pay in 4 or Pay in 6.”

In addition to the new payment options, Affirm has partnered with SensePass, an omnichannel payments-platform provider. Merchants using SensePass’s platform will be able to offer Affirm as a payment option at the physical point of sale, online, or via pay-by-link, or for purchases made over the phone.

“Platform partnerships enable Affirm to accelerate distribution so that more consumers and merchants can access our honest financial products,” an Affirm spokesperson says by email.

Affirm is offered by more than 292,000 merchants in the United States, including Amazon.com, Dick’s Sporting Goods, Newegg, Target, Walmart, and American Airlines.