As the gig economy grows, startups are emerging to meet an expanding market for payment. An especially ambitious example is Willa Inc., which on Wednesday announced an $18-million Series A funding round led by FinTech Collective and including sums from existing investors EQT Ventures and Entrée Capital.

The Ventura, Calif.-based startup says it will use the funds to expand its user base to include what it says is a waitlist of more than 150,000 independent workers. It also plans to introduce a debit card for its clients’ use later in the year.

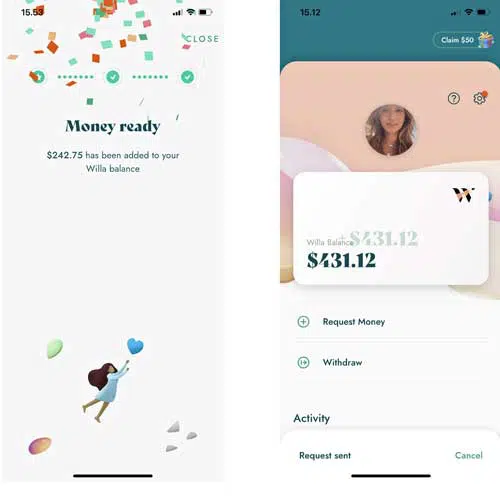

Willa’s proposition includes what it says is instant payment to users of its iOS app. Freelancers use the app to enter details of the work they did, while Willa creates an invoice and delivers it to the client. Willa funds the freelancer’s account within 30 seconds, it says, while clients can pay on their own terms. Users can transfer the funds to a bank account or another app. Willa’s fee to the contractor is 2.9% of the billed amount. With a limited base of users so far, the app was downloaded fewer than 5,000 times in June, according to Sensor Tower.

“Many freelancing tools have seen the light of day, but none solve their biggest problems. As a result, they have no choice but to spend a full day each week on paperwork and still end up being paid late and lose their creativity,” says Kristofer Sommerstad, cofounder and chief executive, in a statement. The company was started in 2019 by a group that includes some of the founders of the music-streaming service Spotify.

Willa emerges as the independent-contractor economy in the United States is expanding, partly in response to the disruptions brought on by the Covid pandemic. The freelance workforce has reached an estimated 56.7 million, up from 53 million in 2014, according to numbers from freelancing platform Upwork Inc. and cited by Willa. At 7%, that’s a faster growth rate than the overall U.S. workforce, which grew from 156 million to 160 million over the same span of time, according to numbers Willa cites.

Competition could be heating up, as the market for payouts to workers in the so-called gig economy has attracted a number of banks and payments companies in recent years, including Mastercard and Bank of America.