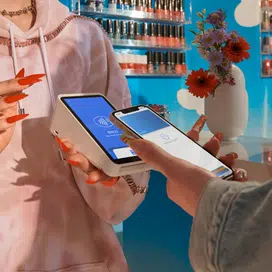

Under pressure from the European Commission, Apple Inc. agreed Thursday to open the contactless-payment technology in its iPhone for payments on wallets from outside developers. The agreement follows two years of investigation by the regulator, which has argued the exclusion of rival wallets from using the iPhone’s near-field communication chip hurt competition by stunting the development of rival mobile apps.

Apple has until July 25 to comply with the agreement, which will stay in force for 10 years and will be monitored by a trustee. The penalty for non-compliance is a fine of up to 10% of annual EU revenue or 5% of daily revenue.

Besides opening its NFC chip to digital wallets other than its own, Apple has agreed not to charge for that access and to enable security technologies such as Touch ID and Face ID, according to the EC. Users will have the option to set any wallet as their “default option,” according to the agreement, and the technology must be enabled for any card, including transit and access-control cards.

“Today, the Commission has decided to accept commitments offered by Apple. These commitments address our preliminary concerns that Apple may have illegally restricted competition for mobile wallets on iPhones,” noted Margrethe Vestager, the EC’s executive vice president, in a Web post explaining the regulator’s acceptance of Apple’s “binding commitments” in the matter. The EC is the executive arm of the European Union, which counts 27 nations as members.

Observers point out that, while Apple resisted opening its contactless chip to mobile apps from outside developers, the new rules may benefit not only developers but also Apple itself. “Allowing access to the iPhone’s NFC capability independent of Apple Pay or Apple Wallet will allow developers and other wallet providers to deliver payment functionality to any wallet or application,” says Thad Peterson, by email. “In terms of its impact on Apple in Europe, transaction volume from Apple Pay or the Apple Wallet may flatten somewhat as other wallets become available, but it also enhances the utility and value of the iPhone for their customers, so it could potentially be a gain for Apple.” Peterson is a strategic advisor at Datos Insights, a financial-services consultancy.

Apple spokespersons did not respond to queries from Digital Transactions News.

Its concession to the regulator in Europe comes as Apple faces compliance issues in the U.S. market. In March, the technology giant said it had “fully complied” with a federal court ruling requiring it to permit app developers to process payments outside of Apple’s own system. The response came after five major companies had filed a petition with the court protesting that Apple’s compliance has fallen short.

Meta Platforms, Microsoft, Match Group, and X (formerly Twitter) filed the argument in the federal district court for the Northern District of California. Audio-streaming service Spotify joined the petitioners later. The court in 2021 had ruled that Apple must allow developers to use outside payments services in a verdict that followed a lawsuit brought against Apple by Epic Games Inc.

Apple has other controversies to contend with in the U.S. market. In March, the company became the target of an antitrust lawsuit brought by the U.S. Department of Justice and 16 state and district attorneys general alleging it maintains a monopoly in the smart-phone market, in part by interfering with apps that could ease the way for consumers to switch to competitive phones.