Apple Pay Later, the buy now, pay later product from Apple Inc. released just over a year ago, is shutting down. The move comes after installment-payment specialist Affirm Inc. confirmed it would be part of Apple Wallet when the tech giant’s annual software updates for iPhones and computers emerge this autumn.

Apple Pay Later, self-funded through the Apple Financing LLC subsidiary, launched in March 2023, having been announced the year before. Affirm announced its upcoming inclusion in Apple Wallet in a securities filing last week following Apple’s Worldwide Developers Conference.

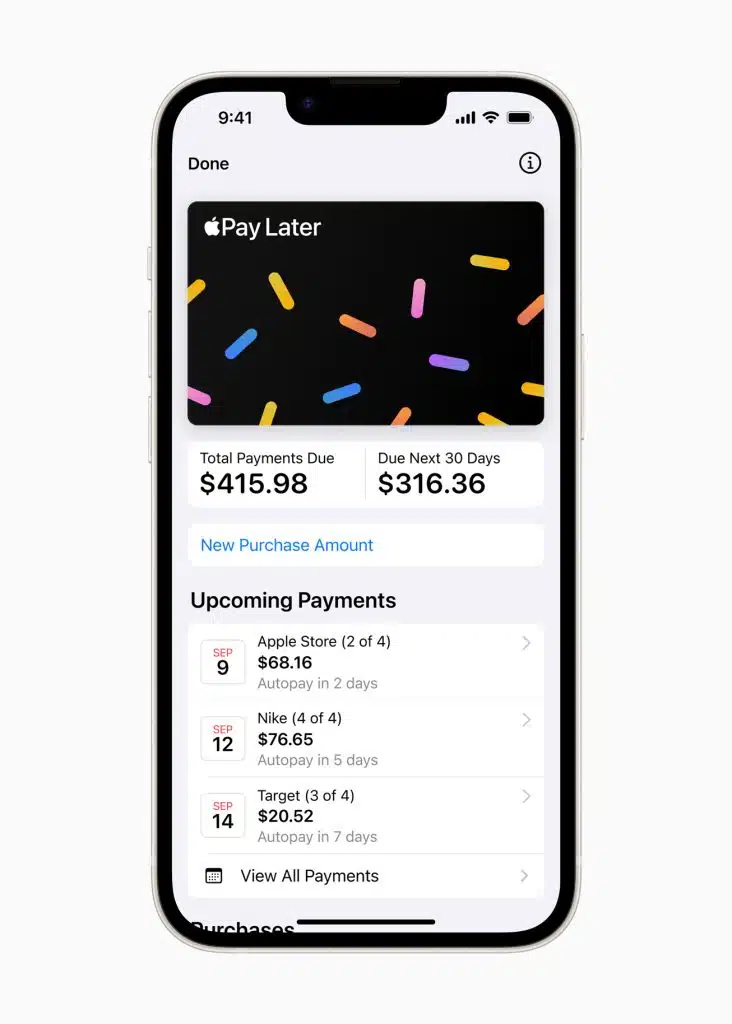

Apple acknowledged the end of Apple Pay Later in a statement. Released to 9to5Mac.com, the statement says “users across the globe will be able to access installment loans offered through credit and debit cards, as well as lenders, when checking out with Apple Pay. With the introduction of this new global installment-loan offering, we will no longer offer Apple Pay Later in the U.S.” Existing Apple Pay Later loans will continue to be serviced, though no new applications will be accepted. Apple has provided no data on Apple Pay Later use or volume.

Apple’s exit from directly supplying BNPL services apparently does not indicate a diminished view of the payment method at the computing giant. The addition of Affirm is likely the first of other possible providers. Apple, in an earlier presentation, says users will be able to access installment loans from eligible credit and debit cards when making a purchase online or in-app with an iPhone or iPad, a feature expected to be available to any Apple Pay-enabled bank or issuer in supported markets.

The buy now, pay later payment method accounted for 5% of all North American e-commerce transaction value in 2023, according to the 2024 edition of the Worldpay Global Payments Report, which forecasts that value will grow to 6% by 2027.

There may be several reasons Apple is leaving the BNPL market, suggests Ben Danner, a senior analyst at Javelin Strategy & Research.

“Unsecured lending is both an art and science; it requires a significant amount of capital and risk provisioning. Traditionally, Apple prefers that a partner accept the balance-sheet risk,” Danner tells Digital Transactions News via email.

Another factor could be that BNPL may have a profitability problem. “It’s difficult to make a profit in lending with 0% interest loans with no fees. The Apple model seemed like it was doomed to fail from the beginning,” he says.

A third factor may be that third-party BNPL providers have honed their models. “Affirm is a market leader and has been in the business for many years now. They have an established place in the U.S. market and a wide base of customers that would overlap significantly with potential Apple Pay Later users,” Danner says. “Apple’s decision to discontinue APL is about offloading risk onto Affirm while giving its customers further flexibility of payment.”

Still, Apple’s move to exit BNPL may not be without cautionary elements. “The real issue is, can Affirm sustain the volume that Apple might bring? And can Affirm avoid another Peloton partner, that was accountable for so much of their revenue? Affirm must balance the benefits of a large partner with the importance of diversification.” Peloton is a subscription-based exercise bicycle.

The demise of Apple Pay Later will have little impact on Apple Pay’s standing among consumers, Danner continues. “Survey data shows that Apple Pay is the top universal mobile-wallet app, and I don’t think the discontinuation of APL will change this position. Apple Pay is fundamentally a different product than what is being offered by the BNPL vendors and enables you to use your credit card to harvest rewards points, or your debit card.”