The payments industry continues to reckon with the myriad ways the pandemic has permanently reshaped how people pay businesses and other people. One key example is how individuals are paying each other compared to just a couple of years ago, and how payment networks are responding.

In just the two years from 2019 to 2021, for example, the share of peer-to-peer payments using cash dropped dramatically, from 61% of payments to 49%, according to data from the San Francisco Federal Reserve Bank. Checks fell to 9% from 12%. But the share for mobile apps soared from 11% of P2P payments to 29%.

That factor has created both an opportunity and a problem for P2P apps like PayPal, Venmo, and Zelle, and even for traditional remittance networks like Western Union: Consumers are warming up fast to digital P2P, but the share of other people and organizations they can pay, or receive payments from, remains limited to those each network can reach. That forces at least some users to load multiple P2P wallets. “They may have their favorite, but they have multiple apps to serve other users,” says payments-industry expert Sarah Grotta.

Earlier this week, Visa Inc. launched what it bills as a solution to that issue, though it won’t be widely available until the middle of next year. The new service, dubbed Visa+, promises to let users signed up with one P2P service make a payment to another person using another network.

The launch partners include PayPal and Venmo, a PayPal-owned service, which will test Visa+ starting later this year, Visa says. Networks signed to come onboard later include DailyPay, i2c, TabaPay, and Western Union. Interoperability will be facilitated by the Visa network serving as what the payments giant calls a “bridge” for P2P payments.

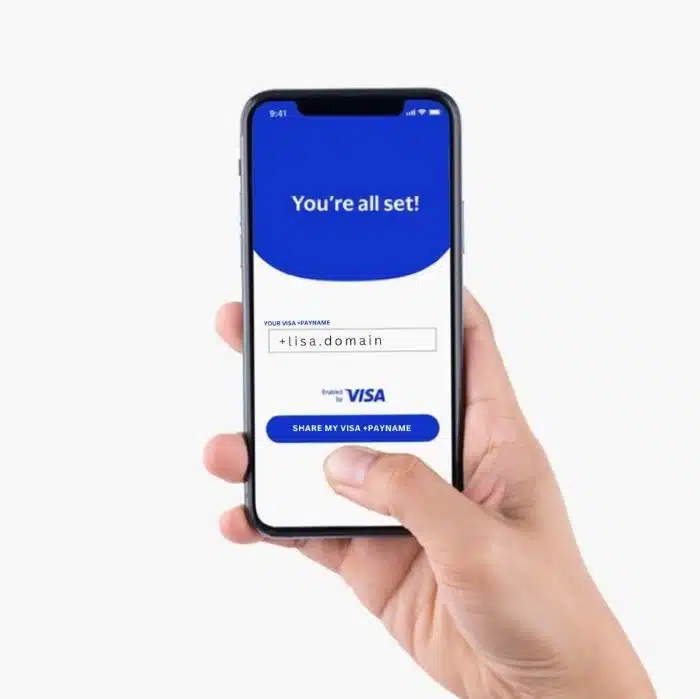

Visa+ doesn’t require users to have a Visa card. Instead, it works with what the network calls a “payname,” which users set up in the app they like to use. They can then share their payname with anyone they need or want to pay or want to receive payments from, using the payment app linked to that payname. Although Visa bills the service as moving funds in real time, funds availability will depend on the banks involved in the transfer and the region they are in, Visa cautions.

The company clearly sees Visa+ moving well beyond birthday money sent from grandma to grandchildren. It envisions payouts to gig workers, such as ride-share drivers, and to marketplaces. The initial participating institutions will enable transfers to a base of “millions” of persons in the U.S. market alone, Visa says, without being more specific.

Interoperability is likely to be a major selling point, given that 84% of consumers say they have used a P2P service, according to a LendingTree survey of nearly 1,000 consumers in May last year. PayPal was the most commonly used app, at 84% of respondents, followed by Venmo (49%). But the third- and fourth-ranked services, Block Inc.’s Cash App (44%) and Zelle (33%), are not among the initial participating Visa+ networks. That creates a big gap, Grotta observes. “Cash App would have to be a big target” for Visa, she says.

Other observers also have reservations. “I’m underwhelmed,” says Patricia Hewitt, head of PG Research & Advisory Services, a payments consultancy, who agrees with Grotta that the absence of the big Zelle and Cash App services is a liability. “Visa and Mastercard have a muddled track record selling services through intermediaries,” Hewitt observes.

Another implication, according to Grotta, is that the range of apps users add is likely to shrink as they begin to adopt Visa+. The service is a “huge convenience,” she says, but could lead to a “battle of the P2P apps,” with developers scrambling to be the one consumers adopt. “The question,” she says, “is how many apps Visa can add.”