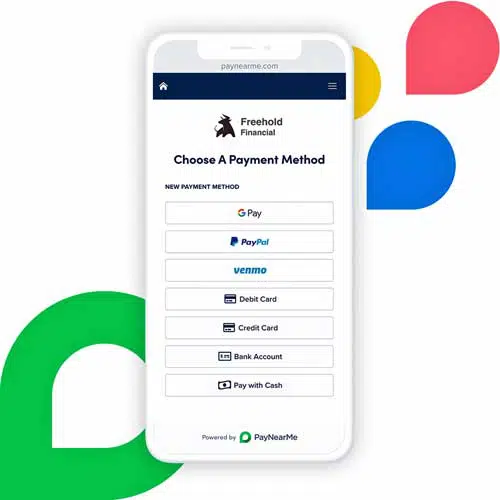

Responding to demand from consumers and billers for digital bill-payment options, electronic billing and payment platform provider PayNearMe Inc. on Tuesday announced the addition of PayPal and Venmo to its payment options.

A recent study by PayNearMe revealed that 43% of respondents rated the convenience of using PayPal to pay bills as important or very important. In addition, more than 27% of consumers cited Venmo as a preferred way to pay their bills, and 35% of Gen Zers and Millennials wanted the option of using Venmo to pay their bills.

“When you look at how consumers pay their bills, PayPal and Venmo are expected options,” says Steve Kramer, vice president of product for PayNearMe. “Younger generations expect instant, digital payment options, and why should bill payment be any different?”

The addition of PayPal and Venmo to PayNearMe’s platform is not expected to cannibalize volume by shifting existing bill payments from one payment type to another. “Every time we have added a new payment channel we have seen an increase in overall volume because it attracts an entirely new base of users,” Kramer says

From a biller’s perspective, accepting PayPal and Venmo transactions through a consolidated platform could help simplify reconciliation of bill-payment receipts. In PayNearMe’s case, the platform automatically categorizes all bill payments, as well the tallying the balance in the account to which those payments were deposited.

“We can even break down how the bill was paid, such as by credit card, check, [and so on]” says Kramer. “As a one stop-shop, we not only connect [billers] to PayPal, but manage reconciliation, which is a benefit for [billers].”

Another benefit for billers in enabling acceptance of PayPal and Venmo is that it creates a self-service channel through which bill payments can be executed with a single click or tap, as opposed to manually entering credit card account data and personal information. In this case, consumers can make a payment with their existing PayPal or Venmo balance.

For billers, adding self-service payments can free customer-service staff to handle non-bill payment-related issues. “Customer self-service options are one of the things we strive for as they remove friction from the payment experience for consumers and [billers],” Kramer says. “[Billers] want ways to move consumers to self-service channels to free up call-center staff for service issues that need more attention and they ask us for self-service solutions.”