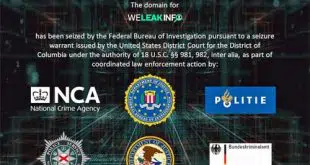

Federal and European law-enforcement agencies last week seized the domain of WeLeakInfo.com, an online site that allegedly held 12 billion stolen records from 10,000 data breaches. The now-shuttered site’s data included names, email addresses, usernames, phone numbers, and passwords for online accounts, according to a news release from the FBI …

Read More »After Beating Wells Fargo Twice in Court, USAA Seeks Dismissal of Mitek’s Mobile-Deposit Lawsuit

Insurer and financial-services provider United Services Automobile Association on Wednesday asked a federal court to dismiss a request by mobile remote deposit capture technology developer Mitek Systems Inc. for a declaratory judgment that Mitek’s technology does not infringe on four USAA patents. San Antonio, Texas-based USAA’s dismissal request came less …

Read More »U.S. Bancorp’s Merchant Volume Rises 10% While BofA Sees Big Zelle Growth

U.S. Bancorp, owner of the big merchant acquirer Elavon Inc., reported Wednesday that its fourth-quarter 2019 merchant volume rose 10.5% year-over-year on a nearly 14% increase in transactions. And U.S. Bancorp rival Bank of America Corp. said its volume for the Zelle person-to-person payments service jumped 76%. Minneapolis-based U.S. Bancorp …

Read More »Fiserv Aims for a Marketing Home Run by Putting Clover’s Name on a Stadium

Fiserv Inc. is breaking new ground, at least in the payments industry, by putting not its company name but the brand of one of its leading products on a stadium. The processor announced Monday that First Data Field, a 7,000-seat stadium in Port St. Lucie, Fla., where the New York …

Read More »Consumers Make More On-Us ATM Cash Withdrawals, Fed Data Show

Despite the decades-old rise of electronic payments at the expense of cash, the rate of decrease in ATM cash withdrawals has slowed down, and more consumers are avoiding fees by using their own financial institution’s ATMs, according to the Federal Reserve. The Fed’s latest triennial payments study released last month …

Read More »Some Fraudsters Are Emphasizing Quality in Their Attacks, Security Firm Says

So-called sophisticated attacks monitored by Mastercard Inc. subsidiary NuData Security jumped 430% in late 2019, with fraudsters deploying more human-aided online attacks rather than fully automated ones in order to fool the defenders. Those findings come from NuData’s “2019: Fraud Risk at a Glance” report released Thursday. NuData is a …

Read More »Square Raises Its Price for Instant and Same-Day Transfers to 1.5%

In its latest pricing change, Square Inc. disclosed Tuesday that it will raise the cost of instant and same-day transfers from its merchants’ Square balances to their bank accounts to 1.5% per transfer from the previous rate of 1%. The change, announced on Square’s blog, took effect Tuesday for new …

Read More »Uber Adds Public-Transit Payment Option in Las Vegas

After rolling out access to public transportation fare payments on its app in Denver last year, ride-hailing leader Uber Technologies Inc. has added a similar service in Las Vegas. Fare-payment software provider Masabi Ltd. said late Monday that it along with the Regional Transportation Commission of Southern Nevada (RTC) and …

Read More »Payment Stocks Sputtered Toward 2019’s End, but They Still Outperformed the Market for the Year

Payment-company stocks lost ground as a group in December and didn’t match the major market indexes in the fourth quarter, but they still bested the indexes for all of 2019, according to a new report. Twenty-six electronic-transaction processor stocks monitored by Chicago-based Barrington Research Associates Inc. posted a negative mean …

Read More »Oklahoma’s Attorney General Says the State’s Credit Card Surcharge Ban Restricts Speech

Proponents of credit card surcharging have received a Christmas present in the form of an Oklahoma attorney general’s official opinion declaring the state’s no-surcharging law unconstitutionally restricts free speech. The development means surcharge bans remain in only four states. State Sen. Michael Brooks, D-Oklahoma City, asked Attorney General Mike Hunter …

Read More »