Former Heartland Payment Systems Inc. chief executive Robert O. Carr has agreed to pay a $250,628 civil penalty to settle an insider-trading complaint filed by the Securities and Exchange Commission, according to court documents filed this week. Carr did not admit or deny the SEC’s allegations, according to filings in …

Read More »Visa’s OK With Pending Mega-Mergers in the U.S. Payments Industry

The pending acquisitions of two leading merchant processors by two leading core financial-institution processors are a “good thing,” Visa Inc. chief executive Alfred F. Kelly Jr. said Wednesday. “We’ve got very good relationships and a lot of history with all four of these players,” according to Kelly. His comments came …

Read More »Zelle Posts $39 billion in P2P Payments on a 72% Transaction Increase

The bank-sponsored Zelle person-to-person payment service continued on its growth trajectory in the first quarter, with transaction volume up more than 70% and payment volume rising more than 50%. Zelle provider Early Warning Services LLC reported Wednesday that first-quarter payment volume hit $39 billion, a 54% increase from just over …

Read More »How an Old Standard Could Trip Up a New Generation of Contactless Payments

The surprising revelation by J.C. Penney Co. Inc. over the weekend that it had ceased acceptance of contactless payments unmasked the little-noticed ability of contactless mobile wallets to work with point-of-sale technology that far predates them but which Visa Inc. wants banished. The blend of old and new has worked …

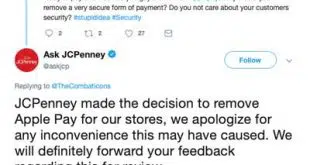

Read More »JCPenney Drops Apple Pay

Department-store chain J.C. Penney Co. Inc. confirmed over the weekend that it no longer accepts Apple Inc.’s Apple Pay mobile-payment service. The move appears to involve a Visa Inc. contactless rule that took effect this month that may have broader implications for U.S. retailers. The confirmation came in a tweet …

Read More »Dunkin’ Adds Other Payment Forms To Its DD Perks Loyalty Program at 1,000 Locations

Coffee, doughnut, and breakfast sandwich aficionados can now pay with credit and debit cards and even cash and still earn points in Dunkin’ Brands Group Inc.’s DD Perks loyalty program at more than 1,000 test stores, Dunkin’ announced this week. DD Perks is one of the nation’s largest rewards programs, …

Read More »Bank of America’s Zelle Transaction Volume More Than Doubled in the First Quarter

The Zelle person-to-person payments service continues to boom for one of its biggest participants, Bank of America Corp., where transaction volume more than doubled in the first quarter. BofA reported Tuesday that its customers sent or received 58.1 million Zelle transactions via email addresses or mobile-phone numbers, up 103% from …

Read More »Shopify Launches a Brand Campaign That Could Give It Some Consumer Awareness

Merchant-services platform provider Shopify Inc. on Monday launched its first North American brand campaign, a marketing effort aimed at entrepreneurs that could have the side effect of making Shopify one of those rare payment processors that has a modicum of brand recognition among consumers. The reason for that is that …

Read More »Its IPO Document Shows the Massive Extent of Uber’s Card Business

Uber Technologies Inc. doesn’t say a lot about its payment strategy in the registration statement it issued Thursday ahead of its highly anticipated initial public offering of stock, but the filing does reveal the ride-share leader is an enormous generator of payment card volume and card-acceptance fees. The statement says …

Read More »Visa To Lower Its Chargeback and Fraud Ratios for Merchants in October

Visa Inc. will lower its merchant dispute and fraud ratios in October. Merchants that exceed the revised ratios could be placed in monitoring programs meant to control risk. Visa hasn’t announced the new standards publicly, but has informed the merchant-acquiring community. Digital Transactions News obtained some of the key new …

Read More »