Banking giant JPMorgan Chase & Co. is discontinuing its Chase Liquid general-purpose reloadable prepaid card and replacing it with a checking account called Chase Secure Banking, which has many of the same features but requires the customer to open a Chase bank account. Launched in 2012 and aimed mainly at …

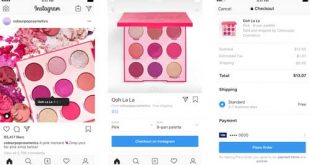

Read More »Instagram Testing Shoppable Ads With PayPal as Its Payments Partner

So-called shoppable ads could get a big boost if a tap-and-buy test announced Tuesday by Facebook Inc.’s Instagram social network succeeds, a test in which PayPal Holdings Inc. is the payment processor. Other social networks and Internet sites have rolled out or begun testing shoppable ads, including Pinterest, Snap Inc.’s …

Read More »FIS And Worldpay: Merger Mania Probably Isn’t Over, Analysts Say

Close observers of the payment-processing industry predicted Fiserv Inc. would start a merger wave when it announced its $22 billion deal to acquire First Data Corp. in January. That prophecy seems to have come true with the even bigger $43 billion FIS-Worldpay merger announced Monday, and the consolidation wave probably hasn’t …

Read More »First Data Rejected Overtures From ‘Party A’ Before Accepting Fiserv’s Merger Offer

First Data Corp. began talking with a potential merger partner identified only as ‘Party A’ more than a year before Fiserv Inc.’s $22 billion takeover offer for the big payment processor was announced, according to a proxy statement Fiserv and First Data filed this week. The lengthy document—more than 300 …

Read More »EVO Plans To Pump Up U.S. Growth While Eyeing Further Foreign Expansion

Merchant acquirer EVO Payments Inc. plans to reinvigorate its lagging U.S. e-commerce business while still pursuing expansion opportunities abroad, its chief executive said Wednesday. Atlanta-based EVO is one of the smaller publicly traded payment processors, and it has a unique business model. Its roots are in the U.S., but today …

Read More »Fed Delay Causes NACHA To Postpone a Third Processing Window for ACH Transactions for Six Months

Automated clearing house governing body NACHA reported Tuesday that a third daily processing window for ACH transactions will be delayed by six months. The window, a component of NACHA’s years-long, multipronged effort to facilitate same-day clearing and settlement of ACH transactions, is now set to go live March 19, 2021, instead …

Read More »Lyft Eyes Ways To Lower Payment-Processing Costs as It Preps for an IPO

With $2.28 billion in losses over the past three years, ride-share provider Lyft Inc. is looking to cut costs—and payment-card acceptance expenses won’t be spared. San Francisco-based Lyft outlined several initiatives it already has started or is planning in a filing earlier this month with the Securities and Exchange Commission …

Read More »Mastercard Bails on Bidding War With Visa for Earthport, Plans To Buy Transfast Instead

Mastercard Inc. has called a halt to its bidding war with Visa Inc. over cross-border business-to-business payments processor Earthport PLC and instead plans to acquire another company in the space, Transfast Remittance LLC. Mastercard announced a tentative deal to buy New York City-based money-transfer provider Transfast Friday. Transfast is a …

Read More »Overstock-Backed Blockchain Firm To Power Multi-National Caribbean Digital Currency

American vacationers flock every year to the scenic islands of the Caribbean, and some day they might be using a digital version of the East Caribbean dollar to pay for a Rum Punch or Ting With a Sting. The Eastern Caribbean Central Bank, the monetary authority for the eight-country Eastern …

Read More »Chase and Wells Expected To Give a Big Boost to Cardlytics, But Revenue Growth Will Lag

Cardlytics Inc. continues to ramp up its rewards platform to accommodate an expected tens of millions of new users coming from new big-bank clients, but revenue growth will lag customer growth for some time, company executives signaled this week. Atlanta-based Cardlytics’s main product, Cardlytics Direct, provides merchant-funded offers to consumers …

Read More »