The fast-growing field of open banking got another boost Monday when the big payment processor Fiserv Inc. announced a major industry player, MX Technologies Inc., will use its AllData Connect service. AllData Connect is part of Fiserv’s AllData Aggregation platform that provides consumer-permitted access to tokenized financial account and transaction …

Read More »ACH and Card Processing Services Lift Usio’s Volumes

Boosted by strong growth in its automated clearing house services, credit card acquiring, and other business lines, merchant processor Usio Inc. reported Thursday that its total dollars processed grew 215% in 2021’s fourth quarter from a year earlier and 184% for the full year. San Antonio, Texas-based Usio processed $9.5 …

Read More »Shift4 Emerges From Its IPO With Less Debt and More Cash

Shift4 Payments Inc. is scheduled to have its first quarterly earnings call as a publicly held company on Thursday. Ahead of that call, company founder and chief executive Jared Isaacman is expressing satisfaction with the merchant acquirer’s June 4 initial public offering. The oversubscribed IPO was priced at $23 per share, …

Read More »Debit And Services Help Mastercard Stay Afloat During the Pandemic

Like its bigger rival Visa Inc., Mastercard Inc. managed to remain profitable during the pandemic-ravaged second quarter and in recent weeks has been seeing improving transaction trends. Mastercard on Thursday reported total U.S. purchase volume of $405 billion in the quarter ended June 30, down 5% from $427 billion a …

Read More »Visa Remains Profitable Despite Pandemic Hits; eBay Volume Jumps 26%

Visa Inc. reported Tuesday that it managed to make nearly $2.4 billion in its June-ending quarter despite massive hits to its international volumes and credit card spending caused by the Covid-19 pandemic, and its chief executive also addressed the latest debit card controversy. Separately, online marketplace eBay Inc. reported its …

Read More »Durbin Asks Fed Chairman for ‘Appropriate Enforcement Action’ Involving Debit Card Transaction Routing

U.S. Sen. Richard Durbin and a Vermont Congressman want the Federal Reserve to look into what they say are efforts by debit card issuers “aided by the dominant card networks” to prevent PIN-debit networks from getting a bigger share of booming card-not-present payment volume. “The Federal Reserve should consider appropriate …

Read More »Garmin Says Outage Doesn’t Affect Payment Data

The ability of hackers to disrupt connected devices was on display over the weekend with Garmin Ltd., a major purveyor of fitness trackers, smart watches and related tech gear, including products that can make contactless payments, reporting service interruptions that some observers say have been caused by a ransomware attack. …

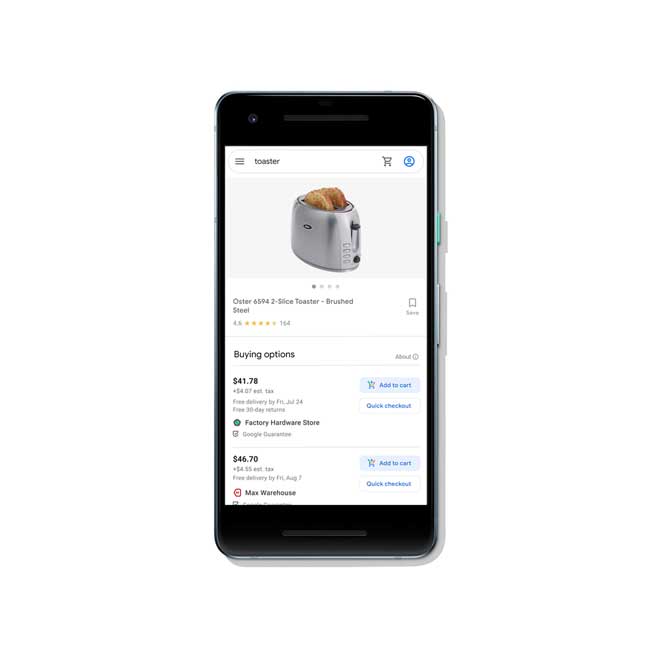

Read More »Google Announces Test With No Commissions for Sellers Using Its Shopping Platform

Expanding on an initiative it began April that offered free listings for some merchants, search-engine leader Google on Thursday announced a test that charges zero-percent commissions to online sellers when they sell a product through its Shopping Actions service. In addition, sellers can use Shopify Inc.’s payment service as well …

Read More »Discover’s Credit Volumes Take a Hit, but the Pulse Debit Network Posts a 12% Increase

Discover Financial Services on Wednesday became the first major payment network operator to report its second-quarter performance, and things weren’t pretty on the credit card side in the wake of the Covid-19 pandemic. Volumes on Discover’s Pulse debit network, however, rose by double digits. Taking the biggest hit was the …

Read More »Shopify Pairs Up With Affirm To Offer an Installment-Payment Option for Small Businesses

The installment-payment movement has gained the big e-commerce services provider Shopify Inc. as a convert with Wednesday’s announcement that Shopify will offer a credit option to its U.S. customers through Affirm Inc. San Francisco-based Affirm, an online credit-services provider, said approved Shop Pay customers at checkout will be able to …

Read More »