The number of EMV chip card-accepting U.S. merchant locations reached 2.3 million in June, up from 2.02 million in March and an increase of 77% from 1.3 million in June 2016, according to new figures from Visa Inc. Visa says in its latest EMV report that half of U.S. storefronts now …

Read More »Researcher Expects Surging Cryptocurrency Transactions To Exceed $1 Trillion in 2017

Driven by higher prices and more usage, the value of cryptocurrency transactions could exceed $1 trillion this year, more than 15 times their level in 2016, a British research firm estimates. Hampshire, England-based Juniper Research in a new report pegs the value of cryptocurrency transactions in 2017’s first half at $325 …

Read More »Google Aims To Leverage Its Millions of Credit Card Credentials for Mobile Commerce

Google plans soon to give merchants access to the vast trove of credit card credentials it has in its databases to speed customer checkout for mobile and online payments. The search-engine giant, however, is not putting itself in competition with payment card networks, a Google executive said this week. The …

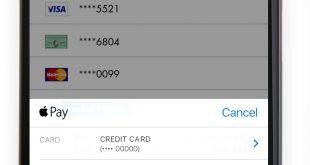

Read More »Payments Professionals Diagnose What Ails Mobile Wallets

There wasn’t a Regular Joe in the room, but that didn’t stop a panel of payments professionals Tuesday from probing the consumer psyche to discern why mobile wallets aren’t more popular. As a percentage of point-of-sale transactions, most experts agree that the major general-purpose mobile wallets—Apple Pay, Android Pay, and …

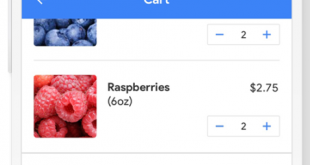

Read More »Seventy Percent of Millennials Have Made an In-App Purchase in the Past Year, Study Finds

Young adults are famous for their enthusiasm for new technologies, and that perception appears to be confirmed by a new study that compared adoption of in-app payments by various age groups. The recently released “2017 U.S. Mobile App Report” from Internet metrics firm comScore Inc. found that 23% of adult …

Read More »The CFPB Didn’t Play Nice, So a Judge Tosses Its Claims Against Merchant Acquirers

After chastising the Consumer Financial Protection Bureau for way it handled itself in its 2015 lawsuit against allegedly fraudulent debt collectors and their payment processors, a federal judge on Friday threw out the CFPB’s claims against the processors. The case is unusual in that Judge Richard W. Story of U.S. …

Read More »AmEx Exits Prepaid Card Program Management With Platform Sale to InComm

The pending sale by American Express Co. of its Serve technology platform to prepaid card program manager InComm moves AmEx more toward the model used by most other general-purpose prepaid card issuers and still keeps the upscale AmEx brand involved in a business mostly oriented toward moderate- and lower-income consumers, …

Read More »Online and P2P ACH Payments Grow 13% While Same-Day Volume Hits $16.6 Billion

So-called native automated clearing house payments that originate electronically rather than by conversion of a paper check continued their robust growth in the second quarter while same-day ACH transaction volume hit $16.6 billion, reports ACH governing body NACHA—The Electronic Payments Association. In total, the ACH network transferred 5.35 billion payments, …

Read More »USA Technologies Swings to Profit as Network Continues Growing

USA Technologies Inc., a provider of payment services for vending machines and other unattended merchant locations, said Tuesday the number of connections in its ePort network grew 32% year-over-year to 568,000 as of June 30, and transaction volume nearly as much. The Malvern, Pa.-based firm also reported net income of …

Read More »RIP: The Obama Era’s Operation Choke Point

The political coroner has made an official pronouncement: Operation Choke Point is dead. The controversial program begun in 2013 by the U.S. Department of Justice during the administration of President Barack Obama aimed to deny payment services to fraudulent telemarketers, payday lenders, and other suspect merchants. It generated massive controversy for …

Read More »