The tug-of-war over Earthport PLC continues. Visa Inc. upped its offer for the British business-to-business payment processor in a bidding war that started after Mastercard Inc. topped Visa’s original price. Visa is now offering 37 pence per share, which values the company at £247 million ($320.4 million). Visa’s new offer …

Read More »Three Weeks From the Announcement, Fiserv Clients Are ‘Incredibly Positive’ About First Data Deal

Twenty-two days of talking to clients haven’t dampened Fiserv Inc.’s conviction that offering to buy First Data Corp. is the right move. In fact, if anything these conversations seem to have buoyed top executives’ confidence in the proposed $22 billion all-stock acquisition of the big processor. “We’ve spent a substantial …

Read More »As the Fiserv-First Data Behemoth Looms, Jack Henry Issues a Subtle Warning

With the proposed merger of processing giants First Data Corp. and Fiserv Inc. looming over the payments landscape, players that both work and compete with the two companies are in a potentially ticklish position. But the chief executive of one such company made it clear Wednesday morning that First Data …

Read More »Restaurants’ Own Apps Command Most Digital Orders, Research Indicates

When the technology emerged, mobile ordering was thought to be a natural for the restaurant industry, and now there’s some research showing just how popular these apps have become. It turns out that, from 2013 through 2017, digital orders at restaurants grew at an average annual rate of 23%, and …

Read More »Going by Share Prices, Investors Like What They See in the Massive Fiserv-First Data Deal

Fiserv Inc. and First Data Corp. argue their proposed $22 billion combination will usher in a processing behemoth that should create substantial operating efficiencies and economies of scale. And so far, investors are buying that story. Shares of both companies are up by double-digit percentages since the Jan. 16 announcement …

Read More »PayPal Chalks up a Big Quarter As It Decouples From eBay And Ratchets up Venmo

In reporting its performance for the fourth quarter of 2018 as well as the full year, PayPal Holdings Inc. indicated its dependence on former owner eBay Inc. is down, Venmo monetization is up, and active accounts are surging. Meanwhile, the San Jose, Calif.-based company said it is entering a potentially …

Read More »TSYS Sets ‘Aggressive Goals’ for Vital But Predicts ‘Headwinds’ From the CFPB’s Prepaid Rule

Top executives at Total System Services Inc. on Tuesday predicted big results from the Columbus, Ga.-based processor’s new Vital line of point-of-sale payment devices but also warned the onset of a massive federal regulation this spring will crimp prepaid card revenues in 2019. They also assured analysts on a conference …

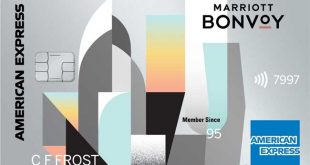

Read More »A New Marriott Card Lineup Lets AmEx Launch a Contactless Expansion

When JPMorgan Chase & Co. announced in November it would soon start mass-issuing contactless Visa cards, industry experts expected the move to at last kickstart a trend in the U.S. payments industry toward tap-and-pay EMV plastic. But while most experts thought Chase’s decision might stir smaller banks to follow suit, …

Read More »Oxman Will Leave the ETA to Head up the Information Technology Industry Council

Jason Oxman, chief executive officer of the Electronic Transactions Association since 2012, is leaving to accept a position as president and chief executive of the Washington, D.C.-based Information Technology Industry Council. He is expected to take up his new duties late next month. In his years heading the 29-year-old ETA, …

Read More »Online Processor Stripe Recruits Funding Circle to Extend Fixed-Rate Loans to Merchants

Stripe Inc. has recruited peer-to-peer financing provider Funding Circle to extend loans to merchants using Stripe to process payments. The London-based lender has joined the Stripe Partner Program, allowing merchants to apply for loans up to $500,000 by uploading data that can support their application. San Francisco-based Stripe says it …

Read More »