In the hotly contested person-to-person payment business, financial institutions have felt left behind by technology impresarios like PayPal Holdings Inc. and Square Inc. that have entered the market over the past few years with slick P2P apps. But on Monday, the banks’ Zelle network released fresh numbers indicating healthy growth …

Read More »Bitcoin Transaction Fees Ease off Sharply, But How Long Will the Trend Last?

Long confirmation times and hefty transaction fees have pushed some Bitcoin backers to back away from the digital currency in recent weeks, but now there are signs that one of those problems is easing significantly while the other is growing much worse. The median transaction fee stood at $5.69 as …

Read More »The Democratization of Bitcoin: An ATM Network Appeals to Average Joes

Bitcoin may have slipped from the near $20,000 price it commanded a little over a month ago, but it’s still selling for around $11,000, nearly a dozen times its value a year ago. That’s drawing in plenty of investors and other high rollers, but it’s also attracting average citizens, including …

Read More »The PCI Council Announces a Standard for Software-Based PIN Entry

For decades, merchants have had to install specially designed and built devices to allow customers to enter their personal identification numbers for debit card payments. And lately, that has been the case for EMV cards, as well. But on Wednesday, that changed as the PCI Security Standards Council published a …

Read More »How a Movie-Ticket App Hopes to Make Voice Commerce a Main Attraction

With voice commerce expected to grow from 18 million users last year to 78 million by 2022, according to Business Insider, sellers of all sorts are starting to pay attention to the technology’s potential to create new transaction markets—and perhaps steal volume from mobile devices. Early enthusiasts for voice are …

Read More »As Amazon Go Opens to the Public, Amazon Ushers in ‘Just Walk Out Shopping’

About a year later than it intended, Amazon.com Inc. on Monday opened to the public an 1,800-square-foot convenience store in Seattle that promises to streamline physical shopping and payment as the company has for decades smoothed out the wrinkles in e-commerce. Along with Amazon’s $13.7 billion acquisition last year of …

Read More »How a Drive for Revenue Puts Pressure on AmEx’s Average Global Discount Rate

Unlike its rivals Visa Inc. and Mastercard Inc., American Express Inc. depends crucially on revenue from the fees it charges merchants for acceptance. These fees, in fact, account for 57% of the company’s overall revenues net of interest expense. So it came as no surprise that AmEx’s top brass spent …

Read More »Cross-Border Specialist Flywire Beefs up Payment Offerings With Its Deal for OnPlan

Flywire Corp., which since its start in 2011 has focused on international payments, on Thursday announced it has acquired OnPlan Holdings LLC, a Bannockburn, Ill.-based company that specializes in payments and receivables management for the health-care and education markets. Financial terms were not announced. OnPlan, with its units OnPlanHealth and …

Read More »Bitcoin Plunges 50%-Plus in 30 Days As a General Rout Slashes Values for Cryptocurrencies

In what may be a case of easy come, easy go, Bitcoin and more than a score of other cryptocurrencies are shedding value fast. Since peaking near $20,000 on Dec. 17, Bitcoin’s price has plummeted more than 50%. It stood at $9,650 at mid-morning Wednesday, down more than $2,000 in …

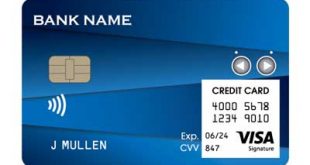

Read More »A Sluggish Uptake for Mobile Payments Opens a Door for Tech-Oriented Payment Cards

When major technology companies started launching mobile-payments services a few years ago, many observers figured digitized and tokenized card credentials would soon replace old-fashioned plastic. But now, the chronically sluggish adoption and usage rates these mobile wallets have registered is lending new life to plastic cards. The twist is that …

Read More »