Contactless cards were tried in the U.S. years ago and soon fell by the wayside, giving the technology a black eye among issuers. Now a report released Monday in the U.K., where contactless is catching on fast, could revive hopes for the technology. Some 325 million debit and credit card …

Read More »A Holiday-Shopping Test Finds Beacon-Based Mobile Offers Drive up Traffic Counts

Marketing campaigns delivered to shoppers’ smart phones have long been seen as a promising way to drive both in-store traffic and mobile payments, and during the recent holiday season one company ran a test to find out just what kind of results retailers could expect. Swirl Networks Inc., a 6-year-old …

Read More »Wal-Mart And Visa Come to Terms, Ending a Months-Long Ban on Visa at Canadian Stores

One of the most intense battles yet seen over card-acceptance costs is over. Wal-Mart Stores Inc. announced late Thursday it has ended its ban on Visa Inc. cards at 19 Canadian stores as of Friday. “We have come to an agreement with Visa which allows us to continue offering Visa …

Read More »As Credit Unions Adopt EMV, They Start To See Quick Gains in Fraud Reduction

Credit unions are making fast progress in their rollout of EMV chip cards, according to an update from PSCU, a major payments processor for this segment of the financial-services industry. Some 85% of PSCU’s clients have introduced, or are introducing, EMV credit cards, while the corresponding number for EMV debit …

Read More »How the Chase Pay-LevelUp Partnership Could Boost Order-Ahead Tech for Mobile Apps

When JPMorgan Chase & Co. decided to recruit order-ahead capability for its Chase Pay mobile wallet, it settled on a 6-year-old mobile payments startup whose technology could give Chase Pay a vital boost in a crucial merchant segment. Meanwhile, the alliance could also bring tens of millions of new customers …

Read More »A Robot Debuts To Find Items in Stores, Take Payment, And Cart Goods to the Car

With online sales soaring, physical retailers are faced with the challenge of how to recreate the convenience of e-commerce in a traditional store. On Tuesday, a 4-year-old startup called Five Elements Robotics unveiled a device that promises to help with that challenge by putting robots at the service of consumers. Once in …

Read More »Google Gets Set to Unveil Android Wear 2.0, With Support for Android Pay

Alphabet Inc.’s Google unit will launch two new smart watches in the first quarter of 2017 that will run on the new Android Wear 2.0 platform and will support Android Pay, Google’s mobile-payments service. Jeff Chang, product manager for Android Wear, announced the news in an interview with The Verge, a tech Web …

Read More »As Bitcoin’s Value Soars, Experts Trace the Cause to a Tumultuous Year of Changes

It’s still far from a mainstream currency, but Bitcoin is closing out a tumultuous year with a raging run-up in value. The digital currency breached the $800 level on Tuesday, and as of Wednesday afternoon was trading just shy of $822. These are heights Bitcoin hasn’t seen in nearly three …

Read More »After an Unsteady Start, Debit EMV Shows Steady Progress, a New Report Indicates

When it comes to the U.S. EMV conversion, it seems as if everything has proceeded more slowly than anyone had expected. Merchants have been slow to adopt the chip technology, EMV certifications have been slow in coming, and consumers and merchants alike have even complained about slow transactions. But now, …

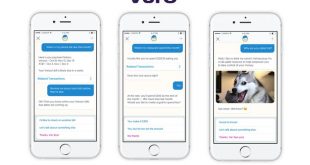

Read More »Varo Money Readies ‘Val,’ a Bot Aimed at Helping Millennials With Money And Banking

Chatbot developer Kasisto Inc. has agreed to provide a so-called smartbot for Varo Money Inc., a San Francisco-based provider of a mobile-only banking app. Both the app and the bot are in beta testing and expected to launch early next year. The new bot, called Val, is based on conversational …

Read More »