The data-sharing routines undergirding a wide variety of payments services offered by fintechs like PayPal and Block depend on open banking, which has emerged to enable crucial information transfers from financial institutions while keeping sensitive account data from falling into the wrong hands. Now the latest update to the rules …

Read More »FIS’s Worldpay Strikes Deals to Support Payments for the HMV Chain And Crypto Platform Alchemy Pay

The big payments processor Worldpay early Wednesday and late Tuesday announced two major deals, one of which will see it supporting multichannel payments for HMV, a London-based seller of DVDs, audio cassettes, CDs, and other entertainment products through a chain of more than 100 stores. The other development, announced late …

Read More »FedNow’s Rising Adoption Buoys Its Biggest Rival, As Well

A big movement among financial institutions to join the Federal Reserve’s FedNow real-time payments network appears to be benefiting its biggest rival, as well. “Ever since FedNow launched, we’ve seen a surge of interest in real-time payments,” says a spokesman for the Real Time Payments network operated by The Clearing …

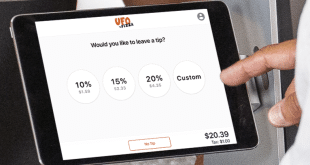

Read More »Revel Systems Signs up Dewey’s As Hospitality POS Rivalry Grows Ever Hotter

In recent years, point-of-sale technology providers specializing in the hospitality industry have had a tough go of it. First came the pandemic, which shut down restaurants across the country. And now, the business has emerged as perhaps the most crowded POS market in North America, with at least a dozen …

Read More »Visa Launches a Service Aimed at Stopping Fraud Caused by Illegitimate Token Requests

Tokenized credentials are supposed to stop fraud by masking card account numbers when a transaction is processed, but according to Visa Inc. global losses owing to illegitimate tokens totaled $450 million last year. That’s bad enough to prompt the network to announce early Wednesday it is launching Visa Provisioning Intelligence, …

Read More »Waffle House And Its Nearly 2,000 Locations Sign up With Olo for Digital Ordering

Digital ordering took off when the pandemic set in, and while Covid has subsided, the appetite for online ordering and payment has only surged among restaurants. Now the trend has claimed a major chain that until now had proven resistant to the technology. Olo Inc., a New York City-based dining-technology …

Read More »How DataVisor Is Harnessing SMS Technology to Combat Fraud From Identity Theft

Short-message service, or SMS, is coming to the aid of fraud managers looking to verify the identity of persons on the receiving end of payments transactions. The technology, which undergirds the well-known texting function between users of mobile phones, can be harnessed to stop fraud, according to security firm DataVisor …

Read More »Amazon Drops Venmo Only a Year After Adding It As a Payment Method

Amazon.com will stop accepting Venmo for payments effective Jan. 10, according to news reports and a page on Venmo’s Web site. “Due to recent changes, Venmo can no longer be added as a payment method. Venmo will remain available to users who currently have it enabled in their Amazon wallet …

Read More »Apple May Be Looking to Replace Goldman, But Will Any Issuer Want the Apple Card?

Apple Inc. may be looking for a new bank to issue its Apple Card, but the big question is whether any potential candidate will want to take it on, some observers say. Apple is apparently taking the initiative in finding a replacement for Goldman Sachs Group, which has issued Apple’s …

Read More »Ackroo’s Deal for GiftFly.com Comes As Sales of E-Gift Cards Are Set to Take off

Digital gift cards are a hot product, and that’s attracting the interest of payments players looking to make acquisitions to enter or bulk up their assets in this market. In the latest deal, the Hamilton, Ontario-based point-of-sale payments platform Ackroo Inc. early Tuesday announced it has agreed to acquire the …

Read More »