The planned expansion of Amazon.com Inc.’s palm-reading point-of-sale technology to all of the company’s 515 U.S. Whole Foods stores, a move the online retailer announced late last week, could represent a major leap for an authentication method few if any other backers have tried. The technology, introduced three years ago …

Read More »More Deals Like the Square Card Coming As AmEx Posts Record Quarterly Volume

American Express Co. is working to sign more card deals like the one it has with merchants using Block Inc.’s Square merchant-processing unit, while cardholder spending and revenue for the company have rebounded to hit record quarterly highs, top executives for the travel-and-entertainment giant said early Friday. The good news …

Read More »It’s Official: FedNow Launches With 35 Banks And Credit Unions Signed up For Instant Pay

The Federal Reserve’s instant-payment service, FedNow, is officially live with 35 banks and credit unions participating, the nation’s banking regulator announced early Thursday. The launch, which culminates four years of work since the Fed first announced its intention to build a real-time payments rail, comes as the payments industry moves …

Read More »FedNow’s Launch Is ‘Imminent’ As Observers Prepare for a New Age in Faster Payments

The Federal Reserve could launch its FedNow real-time payments service as early as tomorrow, sources tell Digital Transactions News. The network, which has been under development for nearly four years, represents the regulator’s first effort to create a nationwide network for instant payments, a service that other countries, and at …

Read More »A Regional Fed Official Sees FedNow Consolidating Networks And Adding P2P

With the Federal Reserve’s rollout of the FedNow real-time payments service expected by the end of the month, a regional Federal Reserve Bank official on Wednesday outlined a roadmap for the new network that includes network interoperability, the possible addition of peer-to-peer payments, and, overall, the prospect of fewer payment …

Read More »It’s Time for Congress to Dump the CCCA And Modify the Durbin Amendment, a Report Argues

With proposals aimed at controlling merchants’ costs for accepting credit cards having re-emerged in Congress, research has been emerging on both sides of the issue this summer as advocates for sellers and card issuers compete to influence any eventual legislation. The latest thrust appeared Monday with a research report arguing …

Read More »FIS Makes It Official: It’s Selling a 55% Worldpay Stake to GTCR at an $18.5 Billion Valuation

In a fleeting 10-minute conference call, FIS Inc. announced early Thursday a move to sell a 55% interest in its merchant-processing business, which principally consists of the Worldpay unit it acquired four years ago, to the private-equity firm GTCR. The deal is expected to close by the end of the …

Read More »FIS Is Reportedly Working to Sell a Majority Stake in Its Merchant Unit to GTCR

FIS Inc. is talking to the private-equity firm GTCR LLC about taking a majority stake in the Jacksonville, Fla.-based company’s merchant-processing business, according to a report late Monday from Reuters. The report indicates the talks are “advanced” and value the stake at between $15 billion and $20 billion. The latest …

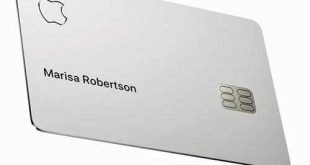

Read More »Why Goldman Sachs Is Looking for the Exit

An overwhelming risk-management burden, coupled with a lack of familiarity with consumer credit, may have triggered the decision at Goldman Sachs Group to negotiate a withdrawal from its agreement to support Apple Inc.’s credit card and its recently launched buy now, pay later service, according to observers. The Wall Street …

Read More »Processors Are Starting to Adopt AI, But Consumers May Not Be Entirely Onboard

The explosive potential that lies in recent advances in artificial intelligence is beginning to be felt in the payments business as banks and fintechs search for ways to wring intelligible trends and operational improvements out of enormous masses of data. The nascent trend toward AI in payments was underscored by …

Read More »