Short-message service, or SMS, is coming to the aid of fraud managers looking to verify the identity of persons on the receiving end of payments transactions. The technology, which undergirds the well-known texting function between users of mobile phones, can be harnessed to stop fraud, according to security firm DataVisor …

Read More »Amazon Drops Venmo Only a Year After Adding It As a Payment Method

Amazon.com will stop accepting Venmo for payments effective Jan. 10, according to news reports and a page on Venmo’s Web site. “Due to recent changes, Venmo can no longer be added as a payment method. Venmo will remain available to users who currently have it enabled in their Amazon wallet …

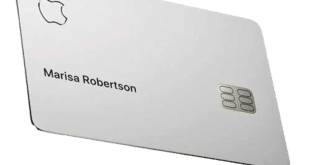

Read More »Apple May Be Looking to Replace Goldman, But Will Any Issuer Want the Apple Card?

Apple Inc. may be looking for a new bank to issue its Apple Card, but the big question is whether any potential candidate will want to take it on, some observers say. Apple is apparently taking the initiative in finding a replacement for Goldman Sachs Group, which has issued Apple’s …

Read More »Ackroo’s Deal for GiftFly.com Comes As Sales of E-Gift Cards Are Set to Take off

Digital gift cards are a hot product, and that’s attracting the interest of payments players looking to make acquisitions to enter or bulk up their assets in this market. In the latest deal, the Hamilton, Ontario-based point-of-sale payments platform Ackroo Inc. early Tuesday announced it has agreed to acquire the …

Read More »Payment Apps Are Making Steady Strides With Consumers, an ETA/TSG Study Shows

Roughly a decade after Apple Pay and other digital wallets burst into the U.S. payments market, the apps seem to be well on their way toward mass adoption, according to consumer-survey results released early Wednesday by the Electronic Transactions Association and the consulting and research firm TSG. In line with …

Read More »A Lawsuit Charges Apple Restricts Competition in Peer-to-Peer Payments

A new federal lawsuit against Apple Inc. alleges the iPhone maker restricts competition in peer-to-peer payments by hampering rivalry with its own Apple Cash app. The restrictions, the suit charges, include provisions against what the suit calls “feature competition,” such as cryptocurrency payments, that could moderate pricing for peer-to-peer payment …

Read More »PayPal’s Executive Hires Are Likely to Propel Its New CEO’s Ambitious Agenda

Sweeping new executive hires at PayPal Holdings Inc., announced Wednesday, will help cement the 25-year-old payments company’s ambitious new direction under recently appointed chief executive Alex Chriss, observers say. “This is PayPal flexing who they are now. They want to be recognized by the world as an equal to Visa …

Read More »Paysafe Continues Its Recovery As It Focuses on Bolstering Growth

Paysafe Ltd.’s chef executive early Tuesday pointed to progress in the processor’s growth plan and outlined moves aimed at bolstering both the company’s product line and its stock. A new digital wallet aimed at U.S. small businesses will launch before year’s end, while the company’s board authorized a $50-million share-repurchase …

Read More »Shift4 Embraces M&A As Its Finaro Deal Finally Closes And More Stadium Business Beckons

The payments business may be shying away from the mergers-and-acquisitions market for the time being, but that’s not a strategy Shift4 Payment Inc.’s boss is interested in imitating. “Now, there’s a general distaste for acquisitions. That’s not a mistake we’re going to make,” declared Shift4 chief executive Jared Isaacman early …

Read More »FIS Still Sees Opportunity in Payments in the Wake of Its Approaching Sale of a Big Worldpay Stake

FIS Inc. is selling a majority stake in its massive Worldpay transaction-processing operation, but that doesn’t mean the company is ditching the payments business, its chief executive made plain early Tuesday. “We have not moved totally away from that,” Stephanie Ferris told equity analysts during an early-morning call to review …

Read More »