Back in March, Paya Holdings Inc. chief executive Jeff Hack indicated his company is eager to build out vertical markets for its processing services, and on Monday it announced a deal that will do just that for Paya’s ambitions in the health-care and non-profit markets. Atlanta-based Paya said it has …

Read More »As AmEx Recovers From Covid’s Impact, Its Vital T&E Market Stages a Comeback in ‘Layers’

American Express Co. early Friday indicated growth rates for total network volumes, while still negative, have rebounded to first-quarter 2020 levels as economies re-open, anti-Covid vaccinations progress in major markets, and consumer travel recovers. “Our overall core business performance was slightly better than our expectations,” said AmEx chief executive Stephen …

Read More »With Its $960 Million Deal for First American, Deluxe Catapults Itself Into Merchant Acquiring

Deluxe Corp. is best known as the largest supplier of checks in the United States, but early Thursday it showed how serious it is about staking a major claim in digital payments. The Shoreview, Minn.-based company announced it has agreed to pay $960 million in cash for First American Payment …

Read More »Online Returns Come to BNPL As Affirm Makes a $300 Million Bid for Specialist Returnly

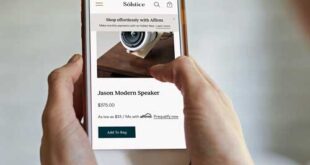

The buy now, pay later trend has eased online purchases for consumers over the past year, but at the other end of those transactions is the flow of returns after buyers get their merchandise. Now Affirm Holdings Inc., a leading player in the fast-growing BNPL arena has attacked the issue with …

Read More »With the Deadline Having Passed, Less Than Half of Sellers Comply With Gas Pump EMV

Saturday has come and gone, and it appears plenty of gas stations—including many branded by major oil companies—are still falling short of chip card acceptance at the pump, despite a deadline for EMV compliance that fell on April 17. Some 48% of fuel and convenience-store sellers have complied with the …

Read More »Nacha Records Booming Same-Day Results As the ACH Confronts Pandemic Concerns

Faster-payment volume soared 88% on the nation’s automated clearing house network in the year’s first quarter compared to the same period in 2020, Nacha reported Thursday. Transactions processed the same day they were initiated totaled 141.1 million, compared to 75 million in last year’s March quarter, the last period before …

Read More »With PayPal, UATP Expands Its Installment Options As Consumer Air Travel Rebounds

It’s a relatively new arrival among payment options for general merchandise, but the newest buy now, pay later concept has been available for air travel for some time, helping boost airlines after a tough year in 2020. In the latest development, Universal Air Travel Plan Inc. on Wednesday announced it …

Read More »Buy Now, Pay Later Reveals a ‘More Nuanced Picture,’ According to the Latest Research

The buy now, pay later capability now offered by myriad providers is sweeping the country, but may include a few drawbacks that could hinder future growth, according to a report issued Monday. Research for the report, which included a survey early this year of some 1,500 U.S. consumers, revealed that …

Read More »A Mastercard Report Estimates As Much As 30% of the Shift to Digital Payments Is Permanent

That the shift toward digital forms of payment was accelerated by the pandemic has been duly noted over the past year, but how much of that change will stick once the U.S. market and the rest of the world gets beyond Covid? Not all of it by any means, but …

Read More »Looking to Serve Bigger Payments, Nacha Sets a $1 Million Same-Day Limit for March 2022

Nacha on Monday announced it will raise its dollar limit on same-day transactions 10-fold to $1 million starting next March. The move, which will come only two years after the governing body for the automated clearing house network raised the cap to $100,000 from the original $25,000 limit, comes as …

Read More »