In a move aimed in part at accommodating digital-only financial institutions, Visa Inc. on Saturday opened its ReadyLink prepaid top-up network for the first time to debit cards. “The expansion makes Visa ReadyLink available to all consumer and business debit cards. The service is optional and issuers need to opt-in,” …

Read More »MagicCube Pockets a $15-Million Round As Device Shortages Spark Interest in Its Technology

The global shortage of semiconductor chips that’s plaguing the makers of point-of-sale terminals and other payment devices has left at least one technology firm sitting pretty, its founder and chief executive says. “It’s wind in our sails,” says Sam Shawki, chief executive of MagicCube Inc. That’s because MagicCube’s technology enables …

Read More »The U.K.’s SumUp Busts Into the U.S. Acquiring Market With Its Deal for Fivestars

In a deal that could have important implications for payments providers like Square Inc. and Stripe Inc., the United Kingdom’s SumUp Inc. early Thursday announced it has acquired Fivestars Loyalty Inc., a San Francisco-based payment facilitator for some 12,000 small businesses. The acquisition, SumUp’s first in the U.S. market, calls …

Read More »FortisPay Is Now Fortis, Signaling Its Stress on Payments Integration for Business Software

As trends such as payment facilitation and integrated payments continue to unfold, at least some payments providers are giving more thought to long-held branding strategies. The latest example is that of FortisPay, which on Tuesday announced it is dropping the “Pay” and is now in the market simply as Fortis. …

Read More »Merchant Acquiring Returns to Fast Growth As Specialized Players Claim an Increasing Share

Despite a temporary setback at the start of the pandemic, merchant acquiring is getting back on a growth track that will see revenue expand at an 11.3% annual clip through 2025, nearly equaling the 11.8% rate chalked up from 2015 to 2019, according to a report and forecast released Monday …

Read More »The First Payments Provider Lines Up at Apple’s App Store Following a Federal Court Ruling

One of the first moves to bring a payment system not controlled by Apple Inc. to Apple’s App Store emerged Thursday and follows a landmark federal-court ruling last month. Paddle Ltd., a London-based payments provider, said it will begin offering the alternative Dec. 7, in line with the terms of …

Read More »The Latest EMVCo Standards Update Aims at Broader—And Streamlined—User Authentication

Stronger authentication for voice-activated payments, as well as streamlined identity checks and support for a wider array of authentication technologies for online payments generally, are included in the latest version of EMVCo’s 3-D Secure standard, the global payments-standards body said Wednesday. EMVCo said its new update, version 2.3, responds to …

Read More »A New Report From Accenture And Afterpay Casts Light on How Fast BNPL Is Taking Hold

On-the-spot installment lending, known now as buy now, pay later, has achieved such a high profile since the onset of the pandemic last year that observers are starting to calculate just how much consumer spending it’s accounting for—and how much risk it might pose for consumers and lenders. A report …

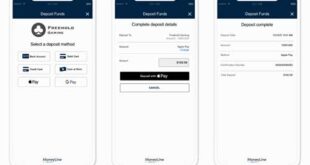

Read More »Eye On iGaming: PayNearMe Launches MoneyLine, And Paysafe Teams With Intralot

The opportunity in online wagering, sometimes called iGaming, is attracting a wide array of payments providers as they adapt their online payments-processing capabilities for this emerging market. On Monday, PayNearMe Inc. launched MoneyLine, a service intended to make it easier for players to receive payouts and make deposits into their …

Read More »What Can Payments Execs Expect From Chopra’s CFPB? ‘Very Aggressive Regulating,’ Say Some

Payments observers are expecting a tougher regulatory approach from the Consumer Financial Protection Bureau with the confirmation on Thursday of Rohit Chopra as executive director of the 10-year old federal agency. “The agency will likely return to the days of director Cordray,” predicts one close observer who asked not to …

Read More »