As the U.S. payments industry prepares to adopt real-time payments, supporters are readying their services. The latest entry is the duo of Fidelity National Information Services Inc. (FIS) and The Clearing House Payments Co. LLC, which announced Tuesday an incubator in which banks and credit unions can take their first …

Read More »A Canadian Car-Services Operator Chooses Contactless-Only Payments

Unattended tire-inflation and vacuum services for cars long have accepted credit and debit cards as well as cash. Now, one provider, Irving, Texas-based AIR-serv, is taking that a step further by making contactless payments the sole option at more than 6,500 locations throughout Canada. Payments provider MONEXGroup says it is …

Read More »Tripling in One Year, Visa Chip Card Transactions Surpass 1 Billion in March

The seemingly plodding U.S. migration to the EMV chip card standard may not be so plodding after all. Visa Inc., in data released Friday, says consumers made 1 billion Visa chip card transactions in March, a tripling of the 303.3 million in March 2016. The number of transactions has steadily …

Read More »Surcharging Programs May Appeal to Merchants, But ISOs And Acquirers Like Them, Too

Offering a surcharging or cash-discounting program to merchants has obvious revenue benefits to merchants, but they have the potential to grow an independent sales organization’s or acquirer’s bottom line, too. Such programs enable merchants to cover their costs to accept credit card transactions by adding a fee to the purchase …

Read More »Merchants And Issuers Alike Will Need Persuading on the New 3-D Secure 2.0

In the run up to full implementation of 3-D Secure 2.0, a payment standard that aims to curb online fraud and prevent blocking legitimate transactions, merchants and issuers alike will need some convincing the technology will not impede e-commerce and mobile commerce. That’s the word from Tim M. Sherwin, chief …

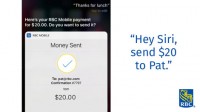

Read More »With Interac’s Real-Time Network Volume Up 50% in 2016, More Services Are on the Way

Interac, the Canadian debit network, says a record number of payments were made in 2016 using e-Transfer, its money-transfer service. Transactions totaled 158 million, up 50% from the 2015 total of 105 million. The total value of these transactions reached C$63 billion (US$47.3 billion) in 2016 with an average transaction …

Read More »Credit Cards Find Increased Favor for Low-Value Purchases, a Survey Reveals

Electronic-payments industry efforts to promote card use may be paying off. Significantly more consumers are using credit cards for low-value purchases of $5 or less than they did in 2016. A CreditCards.com survey released Monday found that 17% of consumers typically used their credit cards for these in-store transactions compared …

Read More »Small Merchants See Value in Debit Acceptance, Less Concerned About Fees, Survey Says

A survey of 500 small merchants that accept debit cards finds that 66% of them are satisfied with the fees they pay, says the Electronic Payments Coalition, a bank and network advocacy organization. Javelin Strategy & Research completed the survey, which the EPC sponsored. The findings are part of the …

Read More »Ant Financial Issues Letter Citing Commitment to MoneyGram’s U.S. Growth

Yet another development has unfolded in the dueling bids for wire-transfer provider MoneyGram International Inc. As Ant Financial Services Group and Euronet Worldwide Inc. compete to acquire MoneyGram, Ant Financial on Thursday issued an open letter to MoneyGram that addresses Ant’s potential commitments to the money-transfer company. In addition to …

Read More »E-Commerce, Partnerships Rank High on New Elavon CEO’s List of Priorities

Jamie Walker’s growth mission as the newly anointed chief executive at Elavon Inc., the acquiring arm of U.S. Bancorp, is squarely focused on e-commerce and furthering the company’s partnerships. That isn’t to set aside its other distribution channels, such as independent sales organizations or its direct-sales efforts, Walker tells Digital …

Read More »