As online shopping continues to stitch itself into consumer behavior, efforts to reduce chargebacks also advance. The latest is Riskified’s Auth Rate Enhance service that can pre-screen orders and provide more information for its customers to make a go-no-go decision on digital orders. Auth Rate Enhance, a component of Riskified’s …

Read More »Mastercard Adds Subscription Tools; Recurly Sees 71% Growth in Software Subscriptions

Mastercard Inc. released Smart Subscriptions, a service to help issuers provide subscription-management tools to their cardholders. In related news, Recurly Inc., a subscription-services provider, released its consumer software subscription benchmark report. The Smart Subscriptions service builds on Mastercard’s Subscriptions Control product, released in 2023, to provide spend analysis, a way …

Read More »U.S. Households Spend $25,513 Annually on the Top 10 Bills

Consumer bill payments for the 10 most essential bills sum to $25,513 annually on average, according to new data from doxo inc., a bill-payments provider. Doxo’s “2024 U.S. Household Bill Pay Report” says that total corresponds to 34% of a consumer’s income spent across mortgage or rent, auto loans, utilities, …

Read More »Play Ball! Shift4 Lands Yankee Stadium; Sound Payments Adds Boarding And Deployment Services

With 29 days until Major League Baseball’s opening day on March 28, the New York Yankees have selected Shift4 Payments Inc. as the team’s concessions and retail sales point-of-sale system provider. Announced Wednesday, the deal will see Shift4 payment technology deployed at Yankee Stadium and at the George M. Steinbrenner …

Read More »Eye on POS: Xenial Is CosMc’s POS System; Olo 2023 Revenue Rises 24%

A new fast-food and beverage concept called CosMc’s is using the Xenial cloud-based point-of-sale system from Global Payments Inc. CosMc’s is a beverage-first restaurant developed by McDonald’s Corp. with one location so far. Xenial, a Global Payments company, supplies it enterprise-level POS system to CosMc’s. Xenial was originally part of …

Read More »Good News for Paze: 44% Would Use a Bank-Provided Digital Wallet

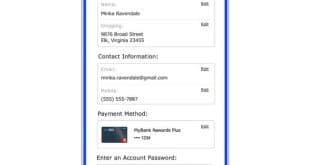

When it comes to online checkout, consumers like using digital wallets. Seventy-two percent of them value digital-payment tools like digital wallets to make the online checkout easier, says Paze in its inaugural Paze Pulse report. Paze is an upcoming digital wallet from Early Warning Services LLC. Backed by seven large …

Read More »Capital One May Acquire Discover. What Could That Mean?

Capital One Financial Corp. may be on the brink of acquiring Discover Financial Services, if two news reports are accurate. The Wall Street Journal and Bloomberg.com separately reported on Monday a deal between the two credit card juggernauts is in the offing, with The Journal reporting an announcement could come …

Read More »Lavu Hits the 1-Billion Transactions Mark Amid a Merchant Billboard Program

Restaurant point-of-sale specialist Lavu Inc. notes more than 1 billion orders have been placed on its POS platform. This comes as Lavu starts a restaurant advertising program featuring billboard advertising. Lavu, which debuted with an iOS app in 2010, now has customers in 65 countries. The billboard program, however, harkens …

Read More »Booming Same-Day ACH Volume Is Up 22%

Volume for automated clearing house transactions cleared and settled on the same day they’re initiated increased 22.3% in 2023, signaling the embrace of same-day ACH by the payments industry, Nacha says. Same-day processing was launched nearly eight years ago. Nacha, a rulemaker for the ACH network, says overall ACH volume …

Read More »Radial Adds Link Money’s Pay by Bank for Account-to-Account Payments

E-commerce platform Radial Inc. is giving its merchants a new payment option that bypasses traditional credit and debit card payments and instead relies on account-to-account transfers. Dubbed Pay by Bank, the service was developed by Link Financial Technologies Inc., which does business as Link Money, an open-banking platform. King of …

Read More »