As digital transactions proliferate, technology is enabling automakers to do more than make it easy to pay for parking from a dashboard. Features that have been standard in many cars, such as heated seats, can now be a service fee away. Such software-related revenue is forecasted to grow at a …

Read More »Google Settles a Play Store Antitrust Lawsuit, But Its Payments Troubles May Not Be Over

Google has settled an antitrust lawsuit over its Google Play payment practices. The suit, filed in 2021, alleged the Alphabet Inc. unit levied fees up to 30% for app purchases made in its Google Play store. The practice, along with Google Play’s 90% share of all U.S. Android app distribution, …

Read More »A Fee Arrangement Lies at the Heart of a Lawsuit Against Apple, Mastercard, and Visa

An Illinois merchant has filed suit against Apple Inc., Mastercard Inc., and Visa Inc., alleging their efforts to develop Apple Pay prevented competition. Filed last week by Mirage Wine + Spirits in the U.S. District Court for the Southern District of Illinois, the suit specifically claims the agreements among the …

Read More »Navy Federal Credit Union Picks Alacriti for RTP Access

With real-time payments perhaps on the cusp of becoming an essential payment service, Navy Federal Credit Union, which rung up $2.7 million in real-time deposits on its first full day on the RTP network from The Clearing House Payments Co. LLC, is using Alacriti to connect to the network. Bridgewater, …

Read More »Software Firm Endava Signs on for an Integration With the Upcoming Paze Wallet

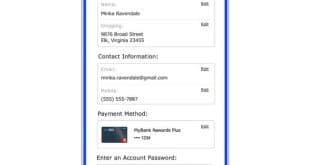

Paze, the upcoming digital wallet backed by banks, has lined up an integration with Endava plc, a software-development firm. Announced Wednesday, the integration, which will be available when Paze launches in 2024, means merchants that use Endava can offer the Paze online checkout. London-based Endava says the simplified checkout will …

Read More »A Benefits Firm Picks Usio for Multiple Payments Assistance

Payments provider Usio Inc. says benefits administrator Genius Avenue will use multiple Usio payments products, including automated clearing house transfers and a prepaid card program, to serve its customers. Announced Monday, the partnership integrates Usio’s payments services with the Genius Avenue platform. Tucson, Ariz.-based Genius Avenue is keen to tap …

Read More »Like Many in Payments, Gateways Seek Software Companies

Software companies are a preferred client for payment gateways, with 74% of gateways targeting them in their sales efforts, according to the latest edition of the Payment Gateway Directory from TSG, formerly The Strawhecker Group. TSG says in addition to software companies as favored clients, 83% of gateways target merchant …

Read More »Relay Payments Extends Its Reach with Its Yesway Deal

Relay Payments, a fintech specializing in payments for the trucking and logistics industries, added convenience-store chain Yesway to its roster of locations. Announced Thursday, the expansion adds to the more than 1,500 truck stops nationwide that accept Relay’s cardless payment method. Yesway also owns the Allsup convenience-store chain. Drivers who …

Read More »3-D Secure Use Drives Down CNP Fraud Rates, Report Finds

Merchants and financial institutions that use 3-D Secure to help vet online transactions in markets that require its use see fraud rates that are three to six times lower than for all card-not-present transactions. That’s one finding from a Outseer-sponsored report completed by the research and consulting firm Datos Insights. …

Read More »Expect a 13% Growth in Black Friday-Cyber Monday Spending, Deloitte Forecasts

With Black Friday and Cyber Monday days away, one prediction calls for consumers to spend an average of $567 in the Thursday through Monday period. Released by consulting and advisory firm Deloitte, the forecast says that average spend will be 13% higher than in the same period in 2022. Perhaps …

Read More »