Acquirers and independent sales organizations wanting to improve their standing among merchants should take note of four trends affecting payments today, according to Bill Dobbins, head of acquiring and enablement at Visa Inc. Dobbins, speaking at the Western States Acquirers Association conference in Las Vegas this week, outlined why the …

Read More »EPSG Marks a New Direction With Its Rebranding to Echelon

Echelon Payment Solutions Group may be a new name in the acquiring industry, but its roots extend to 2006. Once affiliated with EVO Payments and known then as EVO Platinum Services Group (EPSG), Echelon is its own entity offering payment services and providing support for its sales partners. Melville, N.Y.-based …

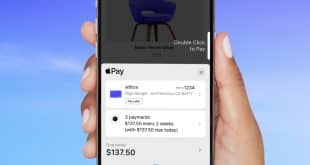

Read More »Affirm Brings Buy Now, Pay Later Back to the Apple Wallet

Consumers with iPhones using the latest operating system now have access to Affirm Inc.’s installment-payments options when using Apple Pay at participating merchants. Released Monday as part of Apple Inc.’s iOS 18 update for its iPhones, the payment option works with any merchant that accepts Apple Pay. The merchant does …

Read More »U.S. Bank Credit and Debit Cards Are Now in the Paze Wallet

Credit and debit cards from U.S. Bank are now ready to use with Paze, the online checkout platform, which comes preloaded with access to up to 150 million payment cards. Paze is in the midst of a national rollout as it seeks to give issuers an edge in e-commerce checkout. …

Read More »Eye on Airlines: UATP Works with Klarna on BNPL; CellPoint Digital Orchestrates Another Airline

Airline payments powerhouse UATP says it will offer buy now, pay later services from Klarna AB. Meanwhile, CellPoint Digital has signed Arajet, a Dominican Republic startup airline as a payments-processing client. UATP, a Washington, D.C.-based global payments network, says its new partnership with Klarna will enable airlines to offer Klarna’s …

Read More »Co-Branded Airline Credit Cards Figure in Federal Rewards Scrutiny

The U.S. Department of Transportation is looking into airline rewards programs with an eye on protecting consumers from potential unfair, deceptive, or anticompetitive practices, the department says. Many consumers use cobranded airline credit cards to earn points in these programs, though the DOT’s focus is on rewards, not on card-issuing …

Read More »PayPal Everywhere Debuts New Rewards for the PayPal Debit Card

With cash back as a favored consumer reward, PayPal Holdings Inc. is broadening its use with the debut of PayPal Everywhere, a rewards program for consumers on the PayPal Debit Mastercard. Announced Thursday, the program includes stackable cash-back offers and personalized ways to manage spending. It enables PayPal Debit cardholders …

Read More »Eye on Processing: EMS’s LegitScript Tie-in for Health Care; Insurer Picks InvoiceCloud for Billing and Payment Improvements

Electronic Merchant Systems LLC is teaming up with LegitScript to give its health-care merchants access to a certification tag, while InvoiceCloud says Western National Insurance Group picked it for a new digital-payment and policyholder-relations service. Cleveland-based EMS, which processes approximately $6 billion in annual volume for 25,000 merchants, says the …

Read More »Ria Lines up an Exclusive Money Transfer Deal at PLS Check Cashers

Ria Money Transfer said it is now the exclusive money-transfer provider at more than 200 U.S. PLS Check Cashers locations, a move that could expose Ria’s services to more than 3 million monthly PLS customers. Announced Tuesday, the deal enables Chicago-based PLS Financial Services Inc. to offer Ria’s money-transfer service, …

Read More »Sephora Loyalty Members Can Now Use Paze Checkout

Paze, the online checkout service from Early Warning Services LLC, says consumers that belong to the Sephora loyalty program can now use it to pay for transactions on the retailer’s Web site. Backed by some of the nation’s largest banks, Paze is an expedited checkout service that includes addresses and …

Read More »